You may be gainfully employed, but yet you live pay cheque to pay cheque. You may even be in a two income household where bot of you earn enough to put food on the table, and your two small children have everything they need, but some months you barely scrape by.

And you're always just one emergency expense away from being completely wiped out. And emergencies do happen. But it's probably our country's rising cost of living that got you here in the first place.

Malaysia has changed and the government is making inroads into political and institutional reforms, but the persistent high cost of living remains an issue that policymakers have not been able to solve. It can safely be heard across the nation that being unable to keep up with rising prices boils down to three main issues of slower growth income, unaffordable property prices, and a weak ringgit. There are other contributing factors such as creeping food prices and changing lifestyles.

When you live month to month, you often find yourself scrambling to make ends meet, which is absolutely stressful and frustrating. Living like this does not only mean that you are unable to spend on some of the things you want, it also probably means that you have only enough to cover your basic necessities. In severe cases, living paycheck to paycheck could lead to increased debts and even dire financial situation.

But if you are done with this financial lifestyle and want to head towards a healthier financial status, here are 5 simple tips to get you out of your funk!

1. Change your attitude towards money

You need to change your mindset towards money if you want to improve your financial situation. One of the most important rules to abide by is to spend less than what you earn. This is a surefire way to ensure that you do not actually overshoot your budget.

Another way to change your attitude towards money for the better is by mingling with the right crowd. Friends with expensive tastes could put a dent in your wallet as you need to spend money unnecessarily to keep up with them. Not only that, always focus on the bigger picture to keep yourself aligned with your financial goals. Instead of splurging on the latest gizmo, it’s advisable that you save up money and use it for long-term investments like buying a house.

2. Learn to budget and manage your money

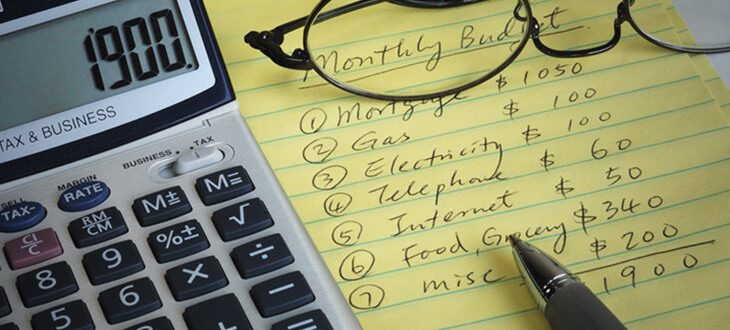

If you are an excessive spender, the term ‘budget’ could possibly be your very own kryptonite! In fact, a lot of people actually take this important step far too lightly. Some people, on the other hand, will write a budget but fail to follow it diligently.

The key to healthy budgeting is that you keep track of all your expenses. From monthly rental payment to yearly car insurance payment, you should list all these expenses down. This is to ensure that you are not surprised when infrequent payments pop up. A proper budget will help you realise how much you have been overspending. There’s tons of apps that can help you to budget effectively such as Mint, Spendee, Goodbudget, and Monny.

3. Prioritize your payments

The most important thing you must do after receiving your salary is to pay your bills such as house rentals, car loan repayments, etc. Next, you should focus on paying yourself, and this does not mean rewarding yourself by buying yet another pair of shoes! Paying yourself simply means setting aside a portion of your salary to go into your savings.

This money should be off-limits unless it is needed for emergencies or long-term investments such as to pay for a down payment on a house. Another important fact to ponder is that many financial experts advise working adults to save at least 20% of their monthly income for rainy days. However, you are always encouraged to save more money once you are able to do so.

4. Scale back on your expenses

When you have a budget, it shows if you have overspending habits and hopefully makes you feel guilty for doing so. So Tip 2 ties in with this tip, which is to cut down on unnecessary expenses. Do you really need to spend RM200 monthly on a gym membership?

While your efforts to stay in shape is commendable, there are other affordable ways to staying healthy. The same goes for other unnecessary expenses like eating out and indulging in retail therapy. Once you begin to trim superfluous expenses, you can work towards paying off all debts and start saving more money.

5. Start investing and diversifying your income

It is quite common for working adults to moonlight, albeit anonymously as this practice may be frowned upon by some employers. Moonlighting or having a second job can definitely help you to reduce the likelihood of living between pay cheques.

Even Meghan Markle used to work as a freelance calligraphy artist in between her acting jobs for extra cash! So, put your hobbies, talents, and skills to good use. There are many websites that allow you to freelance such as Upwork, Favser, and Matdespatch. Not only that, but many Malaysians are also actively working as Grab drivers, which does pay quite well.

Related: 8 Side Jobs for Malaysians to Earn Extra Money During CMCO

Breaking away from the vicious cycle of living on paycheck to paycheck is tough in the beginning but the outcome is extremely rewarding. Follow the tips above and always keep your mind on the prize to achieve your financial freedom.

.png?width=280&name=FI_Lazy_Person_s_Guide_to_Achieving_Financial_Freedom_with_Minimal_Effort-01%20(1).png)