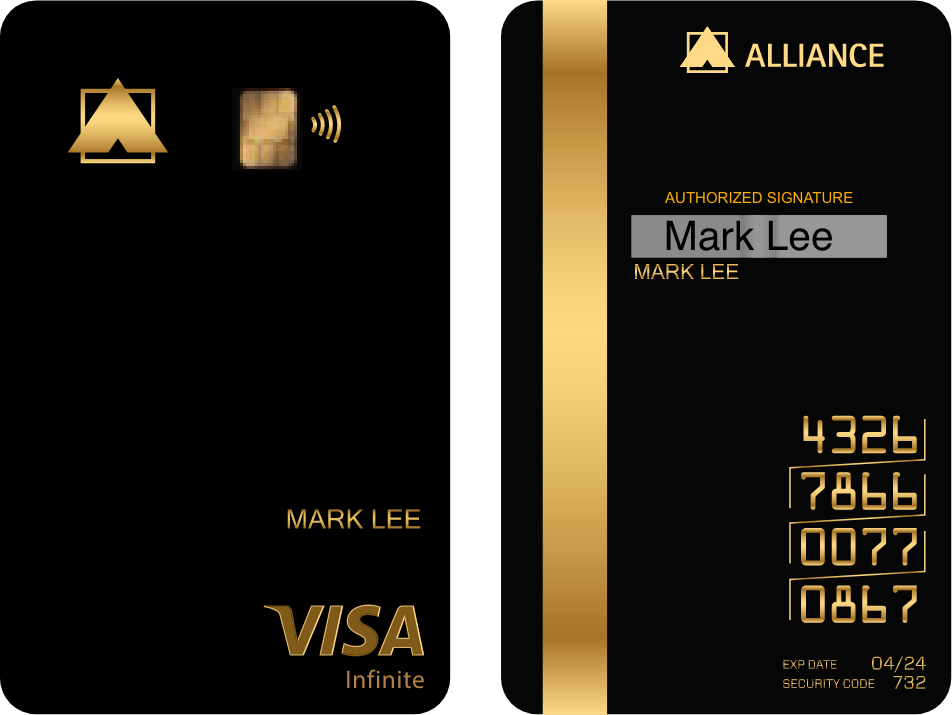

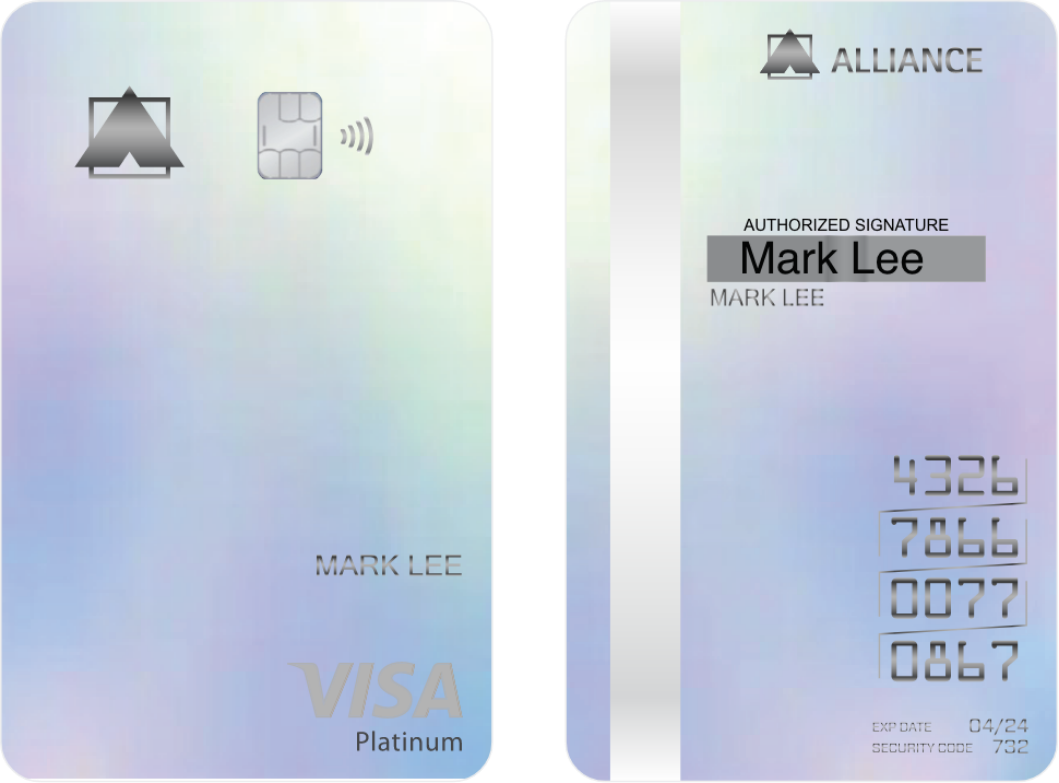

Alliance Bank is a Malaysian bank that offers end-to-end financing solutions for its customers such as credit cards and personal loans.

They also provide other services to its users through its several subsidiaries such as investments and Islamic banking.

Formed in 2001, Alliance Bank has emerged to be the Best SME Bank at the Asian Bank Excellence in Retail Financial Services International Awards in 2015.

The bank is committed in providing unified financial services from investments, consumer banking, business banking solutions and Islamic banking in order to deliver the best customer banking experience.

In 2001, the Alliance Banking Group, also known as the Alliance Financial Group, was formed after a successful merger of seven financial institutions.

Merged entities were introduced to the public as the Alliance Banking Group which constitutes:

-

Alliance Bank Malaysia Berhad or the Alliance Bank

-

Alliance Unit Trust Management Berhad

-

Alliance Merchant Bank Berhad

-

Alliance Finance Berhad

This dynamic and integrated financial services group offers an end-to-end financing solution through various segments such as:

-

Business Banking

-

Consumer Banking

-

Investment Banking

-

Islamic Banking

They continue to grow and expand by providing a wide range of financial products and services which include credit cards, personal loans, home loans, hire purchase and more!