As a long-time avid collector of many things (action figures, model kits, diecast models, etc), the habit of budgeting and managing my money has long been around since I was in sekolah menengah. I clearly remember keeping whatever pocket money I received in a brown-covered notebook that was commonly used in school then. In that very same book, I kept track of my spending on my toys and some food - my mother taught me to make ledgers in it, splitting into credit, debit, and balance at the end of each week.

Pen and paper governed all the filing needs back then, but today we have smartphones, and our smartphones have apps.

Money Lover Review

Back in 2015, I figured that I needed to start being serious about tracking my expenses - I had stopped using the little brown notebook then. Realizing the power of my smartphone, I browsed the Google Play Store for a financial tracker of sorts and came across Money Lover.

What is Money Lover?

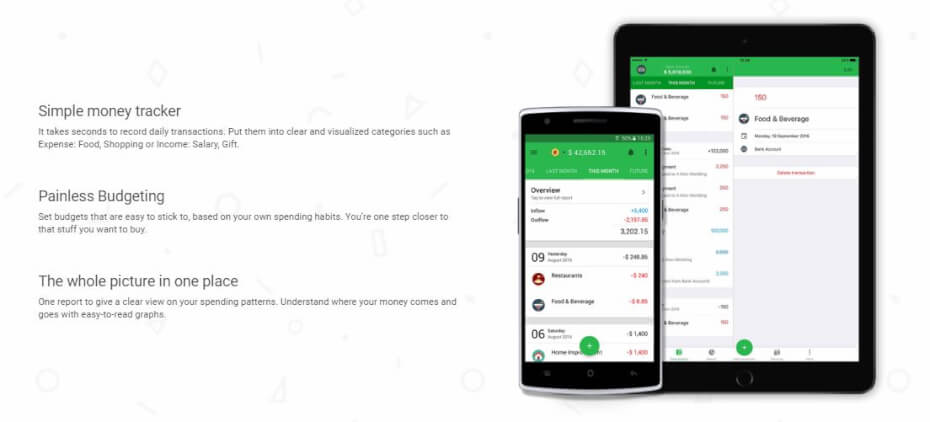

Money Lover is, at its core, an expense tracking app. You can setup several ‘Wallets’ in the app and add transactions (as an expense or income) to each of the wallet at any time, which can also be automated, ideal for monthly bills. In addition to that, there are many other built-in features that are handy, such as a calculator, foreign currency exchange rates, ability to scan receipts, and so on.

For more accurate tracking of your expenses (and as a paid subscription service), Money Lover can also be connected to certain banks and services in Malaysia, such as CIMB, Maybank, Public Bank, RHB, AmBank, Bank Islam, and Hong Leong bank, as well as Paypal. They recently added crypto-currency to its list of linked services too.

Keep in mind that Money Lover is free app, but with limitations. You will have to pay to upgrade your free account to a premium one to get full access to all its features. With the exception of extra icon packs and bank account integration which requires the subscription service.

A free account will only have the following:

- Usage of only 2 Wallets, 1 Budget, 1 Saving campaign, and 1 Event (inclusive of budgets, saving campaign, and event you’ve already completed)

- In-app ads

Paying to upgrade to the Premium version as a one time payment (I paid RM3.90 back in 2015, currently it is going forRM29.99 at 50% off) will give you:

- Unlimited number of Wallets, Budgets, Savings, and Events

- Ad-free experience

- Premium support from the Money Lover team

- Ability to export transactions to Excel or CSV format

- Work and sync across devices and platforms.

See also: CompareHero.my 2017 Banking Apps Awards Winners

Using Money Lover for the past 3 years

I first started out using Money Lover with a single Wallet in the app, tracking whatever cash I had in my real physical wallet at that time. Finding the entire app very useful and intuitive, I soon began wanting to use the app more comprehensively; I paid for the premium version and started using more Wallets to track my accounts, setting up budgets for my hobbies, food, and even my travel expenditure to Tokyo in Japanese Yen.

Using the Money Lover app is actually a very simple experience, though the other features such as having renewing budgets and travel mode come with a small learning curve to fully utilize it. To funnel down the long list of features so it is easy to understand what it can do, I’ve laid down what I use Money Lover for below!

Money Lover Features I use

Tracking my transactions

It goes without saying that the main reason everyone uses a finance tracking app is to keep track of their transactions on a day to day basis. I track every single transaction that I make, be it from the cash in hand or that in the bank accounts. The transactions are tracked by choosing categories, such as food or shopping, but they aren’t just limited to expenses - income is also present, such as the salary category.

A transaction feature I find really nifty in the app is that it is possible to transfer money from one Wallet to another, making it useful to track actions such as funds transfer or ATM withdrawals - it even includes a “transaction fee” option when transferring.

Overview of my expenses

At any time, I can access an overview of my transactions of my wallets at different time intervals. The app provides the overview in a very intuitive pie-chart; I can easily view what categories I spent the most on in that month.

Using the Events and Travel Mode for my holidays

While planning my trip to Tokyo, Japan end of last year, I realized that Money Lover would be an invaluable tool for me to set my budget and also track my expenses before and during the trip. I added in my holiday trip with the Events feature (creatively named “Tokyo Trip”) and set the end date. What the Events feature does is that it groups all your spending (of any Wallets) under one Event, making it easy to look back at related transactions.

With the Event created, every transaction I made in preparation for the trip, such as buying winter clothes, I would tag it under the “Tokyo Trip” Event. While I was in Tokyo, I turned on “Travel Mode” so that every transaction I made would be automatically be tied to “Tokyo Trip”.

I really like this feature as it gives me a clear overview of how much I’ve spent on my trip (it’s well under the budget, phew) and it helps to see where exactly I might have spent a little more than needed.

Transferring between currencies among my wallets

For that very same “Tokyo Trip”, I created another Wallet in Japanese Yen so that I could accurately transfer money to it from another Wallet. The Money Lover app can update internally on the latest currency exchange rates so that when I transferred from Malaysian Ringgit to Japanese Yen, it automatically converted it for me.

Keep in mind that the currency exchange rates in the app are just an estimation based on international rates worldwide and it will be different depending on where you did the exchange. In my case, I had to make some slight adjustments upwards because the money changer had a slightly higher rate.

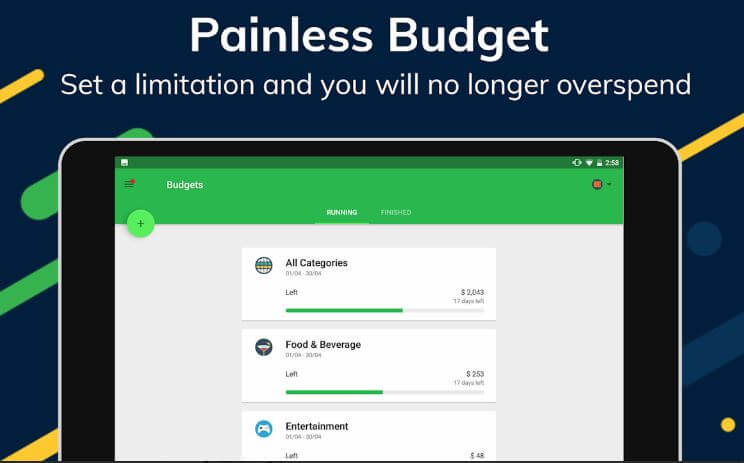

Setting my monthly budgets

For each Wallet I have, I have set up monthly budgets to keep my spending in check. Each budget made can be set to any amount and for any period of time. I typically make budgets for my hobbies and food for a month. Money Lover will give you notifications when you are nearing the limits of your budget and even warn you if you’ve overspent it by a specific amount.

The notifications are a great thing, it does help to make me realize if I’m overspending at any time of the month. It even shows me a chart with my recommended daily spending, projected spending, and my actual daily spending (on average).

See also: 5 Budgeting Apps You Can't Live Without

Reminders for my monthly Bills

We’ve all been there - forgetting to pay that one bill. A little nifty feature in Money Lover is that I can set up recurring bills that are due every month and it will remind me when the due date is near or when I’ve forgotten about it. In the Bills tab, the total sum of my bills of the month is shown, giving me an overview of how much I should set aside that month.

Should you use Money Lover?

As mentioned earlier, Money Lover is simple to use and the many other features it has serve only to enhance just about everyone’s management of their finances. I find the app intuitive to use and it’s green and white theme is very welcoming. I highly recommend everyone to give it a try - it’s free after all!

For Android: Click here!

For iOS: Click here!

For Windows: Click here!

Do you already use an expense tracker? Let us know!

[poll id="14"]