Whether you just received your first payslip or have been working forever but are still puzzled by the details of your payslip, fret not because we’re here to help you understand your payslip better!

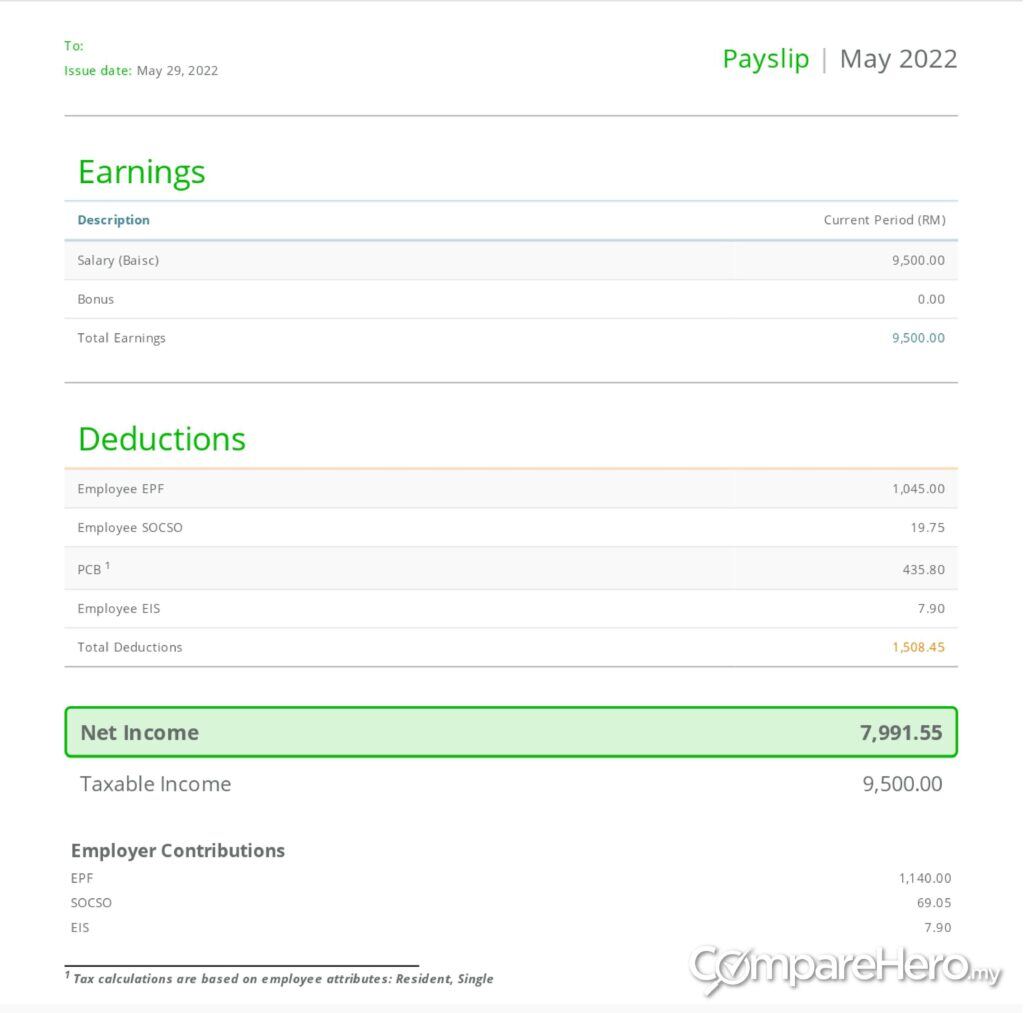

Before we go into the details, as an employee you should receive your payslip whenever your employer pays you in the form of a hard copy or an electronic copy. A standard payslip contains personal details and a breakdown of your salary such as compensation and deductions.

Now let’s understand the terminology used in your payslip:

Basic salary

This is the amount stated on your appointment letter before any deductions. Some companies also use the term gross salary which refers to the same thing.

Allowance

This term refers to the benefits that the company provides you. Some companies provide their employees with transport, meals, mobile phone, and overseas expenses allowance.

Reimbursement

This is a no-brainer. It refers to an expense-paid by your employer for out-of-pocket expenses.

EPF

Employees’ Provident Fund or EPF is a retirement savings fund to ensure you have some sort of savings when you retire.

Since 2007, contributions have been split between two accounts for different types of withdrawals. Account 1 is meant for your retirement and the money in account 2, can be withdrawn to finance education, medical expenses, and housing.

You are obligated to contribute 9% of your monthly income and the good news are you will receive annual dividend payments and it's tax-deductible(up to RM6000 inclusive of life insurance premiums)!

If you notice on your payslip, EPF is stated again under the employer contributions section. This means that your employer will also contribute to your retirement savings.

They will pay a certain percentage depending on your monthly salary. Refer to this contribution rate to find out how much your employer needs to contribute to your EPF.

SOCSO

Social Security Organization (SOCSO) which is also known as PERKESO is a government agency established to provide social security protection to employees and their dependents.

Similar to EPF contributions, your employer is obligated to contribute a certain amount as well.

Learn more about SOSCO and how to submit injury-related claims to the organization, here.

EIS

EIS or Employment Insurance Scheme was introduced in 2018 as a financial policy to help employees who have lost their jobs. If you ever have to deal with unemployment in the future, you can claim your EIS and successful applicants will be given up to three to six months' monthly allowance while they actively look for a new job.

Related: A Complete Guide To Employment Insurance System (EIS) Benefits In Malaysia.

If you’re working in the private sector, you are required to contribute 0.2% of your salary and your employer will have to pay another 0.2%. Government employees, domestic workers, and the self-employed are exempt from EIS.

PCB/MTD

If you see this on your payslip, it simply means that your employer deducts monthly tax payment from your income as what the PCB stands for which is ‘Potongan Cukai Bulanan’.

On some payslips, PCB is referred to as Monthly Tax Deduction(MTD). PCB or MTD is an initiative from Lembaga Hasil Dalam Negeri(LHDN) to help taxpayers make monthly payments instead of paying a lump sum at the end of the year.

Finally, If you notice irrelevant deductions from your salary, be sure to check with the Human Resource (HR) department of your company.

There you have it. We hope you have a better understanding of where your money goes every month!

.png?width=280&name=FI_Lazy_Person_s_Guide_to_Achieving_Financial_Freedom_with_Minimal_Effort-01%20(1).png)