CompareHero.my Team

The CompareHero.my team is comprised of many talented individuals, sharing their knowledge, experiences and research to help others make better financial decisions.

All articles

5 Best Low Interest Rate Credit Cards in Malaysia for 2024

Last updated March

15,

2024

Best Air Miles Credit Cards in Malaysia

Last updated March

01,

2024

5 Best Credit Cards for Balance Transfer in Malaysia

Last updated February

19,

2024

Top 5 Credit Cards with No Annual Fees (2024)

Last updated February

02,

2024

Expert Tips: 5 New Year Financial Resolutions for 2024

Last updated January

22,

2024

Li Chun 2024: Best Auspicious Times To Deposit Money

Last updated January

20,

2024

CompareHero Promotions Terms and Conditions

Last updated December

11,

2023

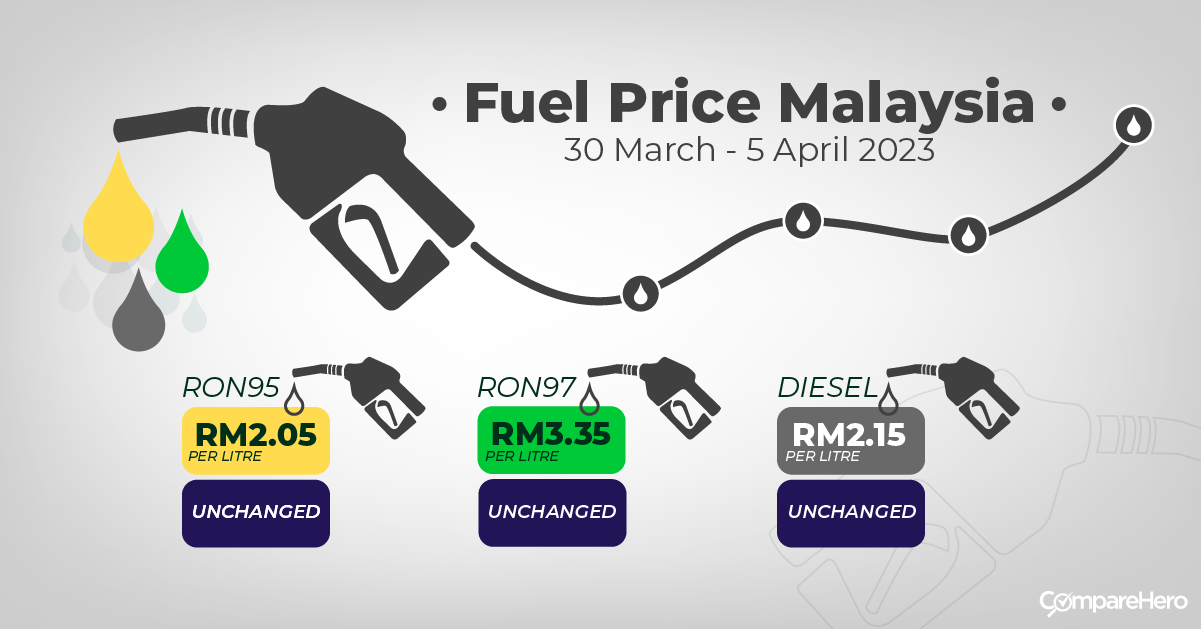

Latest Petrol Price for RON95, RON97 & Diesel in Malaysia

Last updated November

07,

2023

5 Best Credit Cards For Fresh Grads

Last updated November

06,

2023

Ultimate Guide To E-Wallets In Malaysia - Which Should You Get?

Last updated November

01,

2023

Our Mission

We'll help you make your next financial move the right one.