You can’t measure what you don’t manage.

This phrase is particularly true when it comes to your personal finances. You need to pay attention to your money if you want to grow your wealth. And we at CompareHero are very concerned about Malaysians’ financial status. The B40 group are are struggling, the M40 group still find it hard to keep up with rising costs of living. Whether it is saving, investing, insurance, or managing money, the financial health of an average Malaysian highly depends on these fundamentals. So where do you stand?

According to the Visa Financial Literacy Study 2018, 53% of Malaysians are saving to prepare for their futures, while 22% do not keep track of their savings and spending. It also said about 24% of the population avoid keeping a budget and financial record.

Keeping up with cost of living.

Malaysia has changed and the government is making inroads into political and institutional reforms, but the persistent high cost of living remains an issue that policy makers have not been able to solve. It can safely be heard across the nation that being unable to keep up with rising prices boils down to three main issues of slower growth income, unaffordable property prices, and a weak ringgit. There are other contributing factors such as creeping food prices and changing lifestyles.

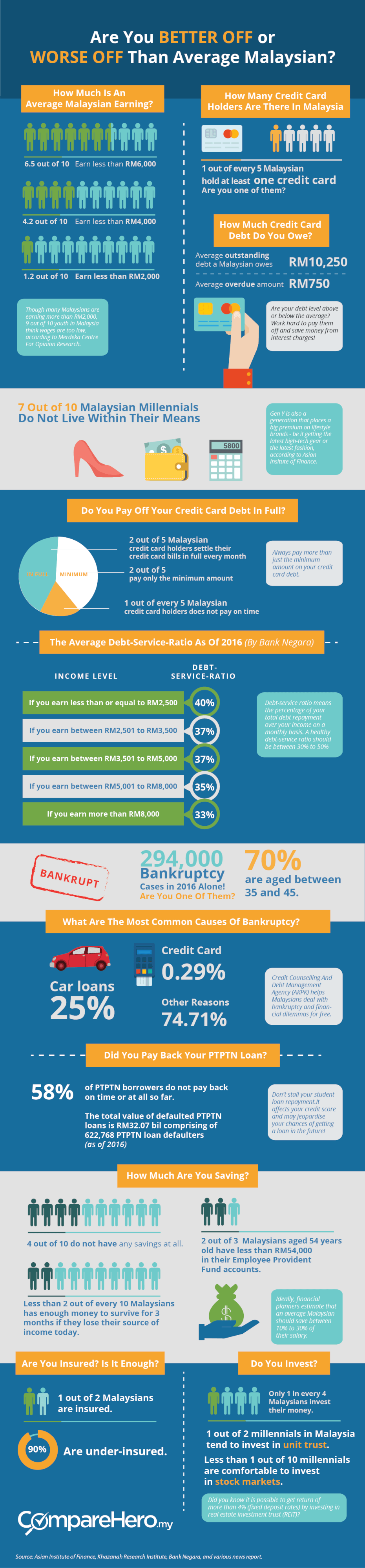

More Malaysians Are Getting Into Financial Trouble

The data on financial problems faced by Malaysians is concerning. Statistics from the Malaysian Department of Insolvency showed over 95,000 individuals have been declared bankrupt between 2014 and 2018 after failing to honour their borrowings with lenders. According to Credit Counselling and Debt Management Agency (AKPK), 943,181 individuals have volunteered for AKPK’s assistance and counselling services, and from that figure, 281,073 participants have participated in the Debt Management Programme (DMP), a programme designed to assist loan defaulters to clear their loans.

In AKPK's Financial Behaviour and State of Financial Well-being of Malaysian Working Adults survey, one out of five working adults did not manage to save any money over the last six months and three out of 10 working adults had to borrow money to buy essential goods. One out of three Malaysians are not comfortable with their financial knowledge, while half of the population (52%) say they face difficulties raising even RM1,000 for emergencies. The main reason why many of them were unable to save was the high cost of living.

National Strategy for Financial Literacy.

The National Strategy for Financial Literacy 2019-2023 was launched in July 2019, that sets out priorities and actionable plans to equip Malaysians with the knowledge to make informed financial decisions and to nurture healthy attitudes in financial management. At the launch, it was revealed that 68% of Malaysians who retire at 55 do not even have at least RM240,000 in their Employees Provident Fund (EPF) account. And that there are situations where 70% of those who withdrew their EPF money use up the money within five to 10 years.