What's so great about American Express cards, and how do they actually work in Malaysia? If you have an Amex card but you’re not sure where and how to use it, we’ve got you covered! From the card usage to the benefits, here’s everything you need to know about Amex, including the best Amex cards you can find in Malaysia. Read below to find out!

Though an American Express or Amex card may not be the easiest one to use due to its limitations, this small piece of plastic does come with its perks and benefits.

The history of Amex goes pretty far back too - it gained popularity in the late 1800s in the United States when it issued its first financial product: traveler’s checks; charge cards came a few decades later. Today, Amex is both a credit card issuer and a card network.

Its duo-role means it serves both as a bank that offers credit cards to consumers and maintains the card accounts, and as a network, aids with card payment processing for merchants that take Amex payments.

Why are American Express cards so rare in Malaysia?

The simple reason why Amex payments is not widely used in Malaysia by both retailers and merchants is due to its cost issues. When compared to MasterCard or Visa cards, Amex cards have a slightly higher payment processing fee.

Additionally, American Express card acceptance outside of the U.S. is still relatively low when compared to Visa and Mastercard, but many merchants still carry and support Amex payments, as having multiple payment options is still a plus for any merchant as well as to cater to the loyal Amex-carrying customers.

You’ll typically find that many luxury brands and higher end stores often accept American Express.

Who would be most suited to get an American Express card?

We’ll be frank - American Express cards aren’t for everyone. Applicants would typically need to have good - if not excellent - credit standing.

If you’re big on cashback and travel rewards, then American Express cards are for you but remember to pay your balance in full each month to avoid hefty interest charges! It’s also worth noting that reward cards tend to have higher interest rates than non-rewards cards.

Though travelling abroad (and even interstate, temporarily) isn’t allowed right now, that doesn’t mean you should put your travelling plans completely on hold. If you are an avid traveller, an Amex card may be a suitable choice for you as it comes with some great travel rewards.

Related: 5 Tips To Get The Most Out Of Your Credit Card

How can you use your American Express card?

In case you didn’t know, Maybank is the exclusive acquirer of American Express in Malaysia. Right now, five Maybank cards come with Amex features. So we decided to break down the features alongside the cards for a more comprehensive look at what you could get with Amex in Malaysia.

Best American Express cards in Malaysia and their benefits

1. Maybank 2 Gold Card

If you’re just about to enter working life, but would like to get a hand on an Amex, then this card might be a good option for you. With a minimum montly income of RM2,500 and zero annual fee, it’s a good entry level card for those who are just about to build up their credit score.

Features and benefits:

- Maybank credit card and American Express card Treatpoints:

| Government Bodies / JomPAY / FPX | No TreatPoints |

| Education Institutions | 1x Point |

| Insurance Providers | 1x Point |

| Utilities | 1x Point |

| 0% EzyPay | 1x Point |

| E-Wallet Reloads | No TreatsPoints |

- Good for Rewards/Offers, Cashback & No Annual Payments

- 5X TreatsPoints for all spend on American Express Reserve card, locally and overseas

- 1X TreatsPoints for Visa/Mastercard® spend

- 5% Cashback for American Express Card spend

- Zero Annual Fee

- Up to 50% savings at all SPG Hotels & Resorts in Malaysia

All in all, it’s a pretty good cashback card for entry level applicants - you get to avoid the annual fee, the requirements aren’t as high, and you still get to enjoy great reward and cashback features.

Click here to apply for Maybank 2 Gold Card

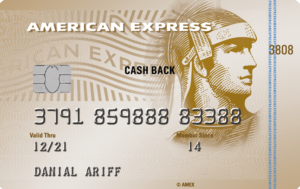

2. American Express® Cash Back Gold Credit Card

Another relatively good entry level card, this card comes with a minimum monthly income of RM2,500 and an annual fee of RM70. What sets it apart from the gold card is that it’s the more attractive option for frequent travellers.

Features and benefits:

- 1.5% cashback for overseas spend

- 1% cashback for other spend

- Unlimited cashback

- Up to 50% savings for dining at Shangri-La Hotel Kuala Lumpur

- Up to 50% savings at SPG Hotels & Resorts

If you’re looking for an Amex card with the typical spartan head, then this comes with that look and feel.

Additionally, it also comes with attractive travel deals like discounts on SPG (Starwood Preferred Guests) Hotels and Resorts, which include hotels like St. Regis, Le Meridien, Westin and Sheraton among others. SPG is a loyalty program and allows users to earn Starpoints on upcoming hotel stays redeemable for reward flights and room upgrades.

Overall, if you give the card a 360 review, you’ll find that it comes with some luxury privileges like discounts on dining while still being affordable.

Click here to apply for American Express® Cash Back Gold Credit Card

3. Maybank 2 Platinum Card

An upgrade from the gold and cashback credit card, the Maybank 2 Platinum Card comes with a higher annual income of RM5,000 but also higher cashback rate, with still maintaining zero annual fee. This card provides a good mix of cashback and rewards benefits.

Features and benefits:

- Maybank credit card and American Express card Treatpoints

| Government Bodies / JomPAY / FPX | No TreatPoints |

| Education Institutions | 1x Point |

| Insurance Providers | 1x Point |

| Utilities | 1x Point |

| 0% EzyPay | 1x Point |

| E-Wallet Reloads | No TreatsPoints |

- Good for Rewards/Offers, Cashback & No Annual Payments

- 5X TreatsPoints for all spend on American Express Reserve card, locally and overseas

- 1X TreatsPoints for Visa/Mastercard® spend

- 5% Cashback for American Express Card spend

- ZERO Annual Fee

- Up to 50% savings at all SPG Hotels & Resorts in Malaysia

Overall, it’s a good cashback and rewards cards that still offers some luxury to users.

Click here to apply for Maybank 2 Platinum Card

4. Maybank 2 Cards Premier

This card was designed for those who live luxury lifestyles.

Due to its RM8,333 minimum monthly income and RM800 annual fee, it may feel out of reach for some, and more affordable to those who are somewhat established in their career. But it makes sense seeing how it comes with a host of luxurious privileges and benefits.

When travelling, for instance, you will get complimentary Accidental Death and Disablement coverage of up to RM1,000,000 for American Express Reserve card as well as travel inconvenience coverage for missed connections, luggage delay and luggage loss.

You also get a host of dining privileges at prestigious restaurants including discounts at expensive eateries such as Arthur’s Bar, Grill Lemon Garden Cafe, Shang Palace and Zipangu, among others.

The card also comes with up major discounts such as a 30% off food and non-alcoholic beverages at some of the most prestigious hotels including Le Meridien KL, Le Meridien Putrajaya, Le Meridien Kota Kinabalu, The Westin KL, The Westin Langkawi Resort & Spa, Sheraton Imperial KL, Four Points by Sheraton Puchong, and Aloft KL Sentral.

Big fan of golf? Well did we tell you that with this card, you get complimentary golf access at world-class golf courses? As well as complimentary Green Fees for card members at selected Golf Clubs? Well you do!

Click here to apply for Maybank 2 Cards Premier

5. Maybank Islamic Ikhwan American Express® Platinum Card-i

If you’re on the lookout for an Islamic credit card that is part of the Amex network, then you’ve come to the right place.

For the benefit of those who don’t know, an Islamic credit card offers perks and features similar to a conventional credit card such as cashback, rewards, airmiles and more, the only big difference is that Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam.

The main differences between Islamic credit cards and conventional credit cards are the prohibition of gharar and riba. Gharar is overcharging, while riba is interest. There are no compound charges as overcharging is also prohibited under Shariah law.

Related: Your Guide To Islamic Credit Cards

Well if you want a card that is both Islamic and has the same amount of good rewards and offers, with no annual payments, then this card might work for you. It also comes with worldwide offers under American Express SELECTS.

Click here to apply for Maybank Islamic Ikhwan American Express® Platinum Card-i

Okay, how else can I use an American Express card?

Beyond what’s listed under Maybank, you should also constantly be on the lookout for other privileges, offers and rewards on the American Express website. The general rule of thumb is that Amex is acceptable at most larger outlets, especially American branded outlets.

Here’s a full list of other outlets that accept Amex:

Grocery and department stores

- Parkson

- Isetan

- Cold Storage

- Aeon BiG

- Ben’s Independent Grocer

Food and beverages:

- Starbucks

- Baskin-Robbins

- McDonald’s

- Kenny Rogers

Fashion:

- Hush Puppies

- Old Navy

- Dorothy Perkins

- Guess

- Zalora

Related: 6 Best Shopping Credit Cards For Malaysians In 2020

Other on-going promotions that you should be aware of:

1. Fave

Shop online via Fave and get RM10 cashback when you spend a minimum of RM40, but be sure to use the promo code AMEX10. This promotion runs until 31 December 2020.

2 Pavillion KL

Though we encourage you to stay at home, if you wanted to do a quick weekend dinner, we’d recommend you book a private room for you and your spouse or partner at either Gran Imperial, Kampachi or Umameat as part of their Journey of Taste campaign with Pavillion KL as it comes with exclusive offers for Amex holders. Click here for more details.

3. Sogo

Stand a chance to win a Proton X70 or gift cards when you spend a minimum of RM10 in a single receipt at SOGO Year End Extravaganza. This promotion runs until 31 December 2020. Sogo is also giving away 30 consolations prizes which include RM100 Sogo gift cards.

4. San Francisco Coffee

Need that quick fix? Well save up to 15% on coffee and beverage when you pay using an Amex card. But read the terms and conditions before buying one.

5. Uniqlo

Earn up to 5x points with every RM1 spent at Uniqlo with your Maybank 2 American Express card. You could also earn 2x with every RM1 spent on other Maybank American Express cards.

Though people are advised to stay indoors at the moment, once movement is more freely allowed, you should utilise your Maybank American Express card at some of the leading malls to earn 5X more points. These places include Bangsar Shopping Centre, Mid Valley Megamall, Suria KLCC, Pavilion Kuala Lumpur, The Gardens, Ikano Power Centre, One Utama and more!

American Express isn’t for everyone, but it comes with attractive rewards

Undeniably this card isn’t for everyone, especially if you are not into the luxury lifestyle or don’t really enjoy travelling.

But if you are someone who does value the glam and glitz, this card may be a good choice for you as you’ll be able to make the most out of it.

But as always, make sure you educate yourself on how to use credit cards before signing up for them!

.png?width=280&name=When%20and%20How%20to%20Move%20Beyond%20Your%20First%20Card_FI%20(1).png)