What Is The Difference Between Life Insurance And Medical Insurance?

- By CompareHero.my

- March 8, 2021

With the uncertain economic situation, ensuring that you and your loved ones will be financially covered should any unwanted circumstances happen is crucial. Well, in a nutshell, Life insurance is insurance that covers the risk of life and pays out an assured sum on the happening of the specified event.

Contents

Health insurance refers to a type of general insurance, which covers the medical expenses of the insured, but only up to the amount covered. Read on to understand the differences between life insurance and medical insurance, and the importance of both types of insurance.

Here is a quick glance at the differences between life insurance and medical insurance:

| Feature | Life Insurance | Medical Insurance |

| Why it is important? | Financially safeguards your family in case of your untimely death. It can help them maintain their lifestyle and achieve their life goals even when you are not around. | Covers costs of hospitalization and related treatment. |

| Core benefit | A Sum Assured will be paid to the nominee of the person | Covers the treatment cost for illnesses or medical conditions subject to a maximum coverage amount and other conditions |

| Types of coverage | Life insurance will cover financial obligations that one may face if they are unable to work due to permanent disability, or provide funds to the policy holder’s dependents upon death. For individual or group coverage. Group life coverage is usually provided as part of an employee benefit | Health insurance provides coverage on medical and hospital expenses. For individual, family or group coverage. |

| Types of plans | Term plans, savings, child-related (wealth creation), retirement and more | Comprehensive health insurance plans, critical illness coverage and more |

| Tax relief | RM6,000 tax relief for life insurance combined with EPF for self and spouse | RM3,000 tax relief for medical insurance premium for self, spouse and child |

What is life insurance?

Life insurance is used as a means to provide financial security for your dependents upon your unexpected death. The Shariah-compliant version of life insurance is known as family Takaful. For suicide cases, nothing will be payable to a nominee if the suicide was within a certain period upon taking up the insurance, which is usually one year.

What does life insurance cover?

There are a few types of life insurance policies available in Malaysia which are:

- Term insurance

- Whole Life

- Endowment insurance

- Investment-linked

- Medical and health insurance

- Life annuity plan

- Supplementary rider or coverage

- Mortgage Reducing Term Assurance (MRTA)

The different types of life insurance will provide different type of coverage. As such, in the event of an unfortunate event, the amount of compensation paid out, and whether or not a disbursement will be given to the nominee, will depend on the life insurance policy taken.

Before taking on a life insurance policy, make sure you are dealing with a licensed life insurance provider. If you are dealing with an insurance agent, always insist to see the agent’s authorization card that is issued by Life Insurance Association of Malaysia (LIAM). Check out Bank Negara Malaysia’s list of licensed insurance and Takaful operators.

Why is life insurance important?

The main purpose of life insurance is for the protection of financial consequences in the event of untimely death of the breadwinner. Life insurance is to replace your income for your dependents such as your children, spouse, parents, siblings or anyone who will be financially affected by your untimely death. Therefore, making a nomination in your insurance policy is important because it will simplify the payout process of your funds to your dependents. If you don’t make any nomination, your dependents will have to obtain a Grant of Probate letter or Letter of Administration of Distribution Order to receive the disbursement.

Related: Why Should You Get Life Insurance?

What is medical insurance?

Medical insurance is designed to cover an individual’s medical and surgical expenses. The injuries, illnesses, diseases and circumstances covered by medical insurance will vary according to the type of medical insurance taken. The more extensive the medical coverage, the higher the policy premium that will be charged by insurance providers.

What does medical insurance cover?

The type of coverage offered by medical insurance can be thoroughly comprehensive, such as compensating for surgical operations, and medical diseases but some may only provide basic coverage, such as covering expenses of hospital rooms and minor medical conditions. Therefore, be careful when taking on a medical insurance to make sure that the policy will suit your medical needs. There are four main types of medical insurance policies in Malaysia:

Hospitalisation and surgical insurance: Provides for hospitalisation and surgical expenses incurred due to illnesses covered under the policy.

Dread disease, or critical illness insurance: Provides you a lump sum benefit upon diagnosis of any of the 36 dread diseases or specified illnesses.

Disability income insurance: Provides an income stream to replace a portion of your pre-disability income when you are unable to work because of sickness or injury.

Hospital income insurance: Pays you a specified sum of money on a daily, weekly or monthly basis, subject to an annual limit, if you have to stay in a hospital due to covered illness, sickness or injury.

Take note that most medical insurance will exclude any pre-existing conditions. This means if you are already suffering from a medical condition, for example if you have hypertension (high blood pressure), you can’t take up insurance coverage to pay for treatment or complications which arises from that illness.

Why is medical insurance important?

A medical insurance will help you to pay for various hospitalization and medical expenses that you will incur if you become ill or injured. These expenses will include a hospital room, professional and surgery fees and medical supplies and services. A medical insurance policy will also help you if can no longer work and earn an income because of illness or injury.

No matter what type of insurance you take on, make sure you understand what is covered and in the insurance policy. Ask for explanations on anything that you find is ambiguous from the insurance company.

Related: 12 Ways You Can Save On Medical Costs In Malaysia

Save

Save

Save

Save

Save

Save

Save

(Video courtesy of Washington Healthplanfinder)

Read More

2021 Malaysia Income Tax e-Filing Guide For Newbies

- By CompareHero.my

You can almost hear the groans about filing of taxes from everyone. It’s time to do your income tax again, everyone! (do it before 30 April 2021 for manual filing and 15 May 2021 for e-Filing).

For new tax-payers, we’re going to make it easy for you with an easy-to-use guide. Starting from tax paying eligibility to the great benefits you can get from filing your taxes online – read on!

Contents

First thing’s first: You have to find out if your annual income is taxable as a resident in Malaysia.

Am I taxable?

To be taxable, you have to fulfill certain requirements as a resident in Malaysia.

- An individual who earns an annual income of RM34,000 (after EPF deductions)

- An individual who earns income a business (though gains or business profits)

If you fulfill the requirements, then you are definitely taxable. The next thing you should do is to file your income tax – do it online!

Income tax deadline 2021

- manual filing deadline: 30th April 2021

- e-Filing deadline: 15th May 2021

You can file your taxes on ezHASiL on the LHDN website.

How to file your personal income tax online in Malaysia

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. You can now pay your taxes and get your tax returns online (or through other methods). This will save you time and frustration by keeping you away from the crowds.

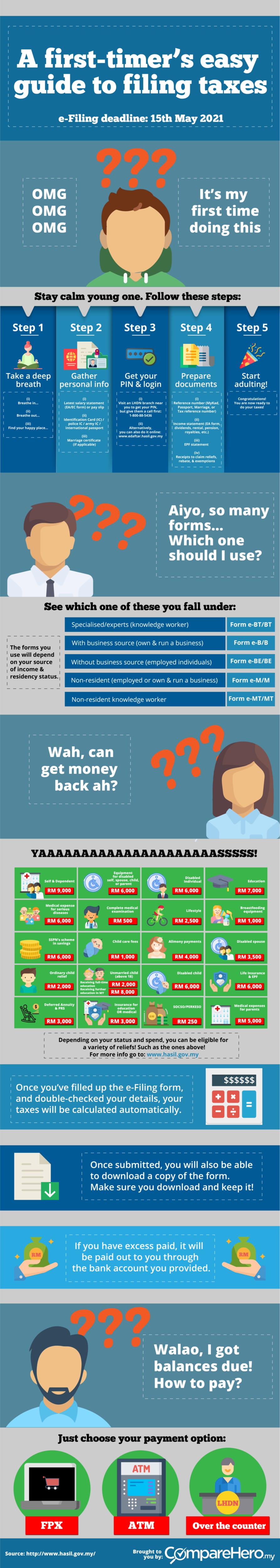

The infographic below will help you:

A first-timer’s easy guide to filing taxes 2021

- Register at LHDN

- If you are newly taxable, you must register an income tax reference number.

- Register at the nearest IRBM (Inland Revenue Board of Malaysia)/LHDN (Lembaga Hasil Dalam Negeri) branch OR register online at hasil.gov.my

- Provide copies of the following documents:

- Latest salary statement (EA/EC form) or pay slip

- Identification Card (IC) / police IC / army IC / international passport

- Marriage certificate (if applicable)

- e-Filing first timers nust apply for a PIN number at the nearest IRBM/LHDN branch (required for first-time login)

- Basic requirements for filing taxes

- Ensure you have the following ready for your e-filing:

- Reference number (MyKad, Passport, Marriage, or Tax reference number)

- Income statement (EA form, dividends rental, pension, royalties, etc.)

- EPF statement

- Receipts to claim reliefs, rebate, & exemptions

Which forms to use

- Ensure you have the following ready for your e-filing:

- The forms you use depends on your source of income and residency status:

- Form e-BE/BE: Individuals without business source (employed individuals)

- Form e-B/B: Individuals with business source (own & run a business)

- Form e-BT/BT: Individuals who are specialised/experts (knowledge worker)

- Form e-M/M: Non-resident individual (employed or own & run a business)

- Form e-MT/MT: Non-resident individual who are specialised/experts (knowledge worker)

- Tax reliefs & rebates (for more info, go to www.hasil.gov.my)

- Depending on your status and spend, you can be eligible for a variety of reliefs:

- Self & Dependent – RM9,000

- Medical expenses for parent(s) – RM5,000

- Basic supporting equipment for disabled self, spouse, child, or parent – RM6,000

- Disabled individual – RM6,000

- Education – RM7,000

- Medical expense for serious diseases – RM6,000

- Complete medical examination – RM500

- Lifestyle – RM2,500

- Breastfeeding equipment – RM1,000

- SSPN’s scheme in savings – RM6,000

- Child care fees – RM1,000

- Alimony payments – RM4,000

- Disabled spouse – RM3,500

- Ordinary child relief – RM2,000

- Each unmarried child (18 years & above)

- receiving full-time education – RM2,000

- receiving further education in MY (award diploma or higher); outside of MY (degree or higher) – RM8,000

- Disabled child – RM6,000

- Life Insurance & EPF – RM6,000

- Deferred Annuity & PRS (2012 – 2021) – RM3,000

- Insurance for education OR medical – RM3,000

- SOCSO/PERKESO – RM250

- Payment options

- Fill up the e-Filing form and double-check all your details in the Summary section.

- Your taxes will be automatically calculated.

- If you have excess paid, it will be paid out to you to your bank account you provide.

- If you have balances due, you can pay through FPX, an ATM, or over the counter.

Source: http://www.hasil.gov.my

Read More

Easy Payment Plan (EPP): How Credit Card Instalment Works In Malaysia

- By CompareHero.my

- March 5, 2021

This article was first published on July 16, 2018 and has been edited and updated for accuracy and clarity.

You may have heard of this credit card feature before, but do you know how instalment payment plans work? Learn more about it here and how you can take advantage of instalment payment plans now.

Contents

What is an instalment payment plan?

Instalment payment plan or easy payment plan are actually the same thing. Essentially it is a feature which gives you the flexibility to use your credit card to make a payment for a substantial amount then repay it in instalments within a certain period. The duration for the instalments will depend on the financial institutions or credit card issuers. However it usually ranges from 3 months to 24 months.

Instalment payments are particularly useful for larger purchases such as electrical items and furniture. However there are certain things you need to know to take advantage of this feature.

Related: Credit Card 101: Everything You Need To Know About Credit Card

How do I take advantage of an instalment payment plan?

1. Make sure the interest charges are zero

In order to take advantage of an instalment payment plan, make sure it offers you a zero percent interest rate. Depending on your credit card issuer as well as the participating merchants, sometimes there may be a one-off payment or other fees involved when you use this feature.

Tip: Read through the terms and conditions, it may be a bit tedious but that’s how you will know whether there are any hidden costs in your purchase through instalment plan!

2. Make sure you purchase from participating merchants

Before you run off to the store to make that big purchase you have been eyeing, make sure to check if the store is on the list of participating shops for your credit card’s instalment payment plan. Most instalment payment plans are only limited to participating merchants, which means usage of instalment payment plans are more limited unlike your credit card which is accepted at most places.

3. Know the terms and conditions

Similar to other purchases made with your credit card, you will have to pay for the instalments on time, otherwise there will be consequences. For example, if you miss your instalment payment, the 0% interest rate may be retracted without notice and you will be charged with normal interest rates which could range between 12- 18% for the entire outstanding balance until you pay it all off.

Therefore, in order to optimise this feature you must be disciplined and not miss any payments. If you miss any payment it may result in you paying a lot more because of the penalty and revoked 0% interest!

Aside from that, some banks will allow you to opt to pay for the 5% minimum amount instead of the agreed monthly instalments. But it is important for you to know that If you pursue this option you will still be charged with interest on the outstanding amount.

Related: How Credit Card Minimum Payments And Interest Are Calculated

Planning out how to properly distribute your budget will help you save money and out of debt.

When to use an instalment payment plan?

Electronic gadgets, like a new mobile phone or laptop can be expensive and can set you back financially. If you make the payment with your credit card, but cannot afford to pay off the amount in full at the end of the month, you will then be incurring interest every month on the outstanding balance. So if you’re thinking of upgrading your phone or are in the market for a new gadget, look out for instalment payment plans so you won’t feel like you’ve just had to part with a huge amount of cash in one go.

Let’s say you want to buy a Macbook. If you have a CIMB credit card, you can pay for it in instalments at 0% interest with the CIMB Bank’s 0% Easy Pay. But this is if you get the Macbook at Machines, as it is one of the participating merchants. You can then stretch repayment up to 36 months.

As appliances like a fridge or microwave are also generally pricey items and fall under big purchases, if the option of paying for it in instalment is available, you should use it so it can help with managing your finances and cash flow.

Related: Credit Card 102: Using your card

When not to use an instalment payment plan?

Services like gym memberships or salon packages. Keep in mind that you will still have to make instalment payments to the bank even if a service provider goes out of business. So avoid using EPP to pay for services. Here’s another word of caution. Don’t make purchases that you cannot afford. EPP should only be used so that you can have better cash flow instead of having to use up your cash for a big purchase. Don’t make that big purchase if you know you cannot afford it in the first place.

This is because even though you can make various types of purchases in instalments, you can lose your money if you are not disciplined. If you miss your instalment payment, the 0% interest rate may be retracted without notice. You will then be charged with interest rates that could be as high as 18% for the entire outstanding balance until you pay it all off! On top of that, they may also be late payment charges, so you end up paying a lot more in the end.

Remember using an EPP will also affect your credit card’s available credit limit. For example, if you have a credit limit of RM10,000, and you use an EPP to buy a new mobile phone that cost RM3,300, you will now only have RM6,700. But your credit limit will return to its original amount as you pay off your instalment payments. Check out the best instalment payment plans below so you can take advantage of it:

Related: What Happens If You Make Late Credit Card Payments

How instalment payment plans can impact your credit score

Missed instalment payments will also be recorded on your credit reports. Generated by credit reporting agencies, these files show your history of repaying bills, the amount you owe, the number and types of credit cards and loans you currently have, as well as how long you have serviced the debt.

All these factors will be taken into consideration when credit reporting agencies calculate your credit score, a three-digit number that indicates your creditworthiness and how likely you are to repay debt. So if you are not servicing your EPP, this will subsequently lower your credit score. With a low score, It’ll be harder to get any future bank loans and credit card applications approved, as banks are less likely to take a risk by lending money to you.

On the other hand, if you pay your bills on time, using an instalment payment plan can improve your credit score as your track record of prompt repayments will be recorded as well.

The best instalment payment plans in Malaysia

Need a credit card that offers instalment payment plans? Check out these options:

Alliance Bank Flexi Payment Plan

- 3-Month Flexi Payment Plan (FPP) At 0% Fee.

- Minimum amount of RM500 in a single retail transaction, local or overseas.

0% HSBC Card Instalment Plan

- 0% interest rates

- Fixed monthly repayments

- Choose a range of tenure from 6 months to 36 months

- Shop at more than 500 merchant outlets

Maybank EzyPay

- 0% interest rate.

- Instalment plan duration between 3 to 36 months (depending on the participating merchants).

- Choose from a huge selection of participating merchants

- Applicable to all new and existing Visa/ MasterCard/ American Express Credit Cards issued by Malayan Banking Berhad or Maybank Islamic Berhad.

Read More

Perbezaan Insurans Hayat dan Insurans Perubatan

- By CompareHero.my

Dalam keadaan ekonomi yang tidak menentu, peruntukan kewangan untuk diri sendiri dan yang tersayang sebagai persediaan kecemasan sangat penting. Salah satu cara ialah melalui perlindungan insurans, sama ada insurans hayat atau insurans perubatan. Ketahui perbezaan antara kedua-dua insurans ini, dan kepentingannya.

Contents

Ringkasan perbezaan antara insurans hayat dengan insurans perubatan

| Ciri-Ciri | Insurans Hayat | Insurans Perubatan |

Mengapa ia penting? |

|

|

Manfaat utama |

|

|

Liputan perlindungan |

|

|

Jenis pelan |

|

|

| Pelepasan cukai |

|

|

Apa itu Insurans Hayat?

Insurans hayat ialah salah satu pilihan untuk sediakan bantuan kewangan kepada tanggungan sekiranya anda meninggal dunia. Pelan insurans hayat yang patuh Shariah ialah Takaful Keluarga.

Namun, terdapat pengecualian untuk kes bunuh diri. Dalam kes ini, jika pemegang insurans membunuh diri dalam satu tempoh tertentu (biasanya setahun) selepas mengambil insurans, tiada pembayaran akan dibuat kepada penama.

Apakah liputan perlindungan Insurans Hayat?

Antara perlindungan yang ditawarkan insurans hayat di Malaysia ialah:

- Insurans bertempoh

- Insurans seumur hidup

- Insurans endowmen

- Insurans berkaitan pelaburan

- Insurans kesihatan dan perubatan

- Insurans untuk penumpang

- Mortgage Reducing Term Assurance (MRTA)

Jenis insurans hayat di atas menawarkan jenis perlindungan yang berbeza. Jika berlaku kemalangan, jumlah perlindungan yang bakal dibayar serta kelayakan penama untuk menerima bayaran tersebut bergantung kepada jenis perlindungan dan jenis polisi yang diambil.

Sebelum anda mengambil polisi insurans hayat, pastikan anda berurusan dengan ejen sah yang berdaftar. Periksa sama ada ejen tersebut memiliki kad kuasa yang dikeluarkan oleh Persatuan Insurans Hayat Malaysia (LIAM). Sebagai panduan, rujuk senarai ini untuk ejen dan syarikat insurans berdaftar dari Bank Negara.

Mengapa Insurans Hayat penting?

Objektif utama insurans hayat ialah untuk menyediakan sokongan kewangan, dan melindungi tanggungan anda terhadap ibu bapa, pasangan, anak-anak, ataupun adik-beradik yang akan terjejas sekiranya anda ditimpa kemalangan, ataupun meninggal dunia. Jadi, sewaktu memohon insurans hayat, pastikan anda turut menyenaraikan penama. Ini bakal memudahkan proses pembayaran insurans tersebut. Jika tiada penama, tanggungan anda perlu menyediakan surat Pemberian Probet atau Surat Arahan Perintah Pembahagian untuk menerima bayaran insuran tersebut.

Lihat juga: Sebab Anda Perlukan Insurans Hayat

Apa itu Insurans Perubatan?

Insurans perubatan menawarkan perlindungan untuk menanggung kos perubatan dan pembedahan. Jenis kecederaan, penyakit, dan rawatan yang diliputi oleh insurans perubatan adalah berbeza, bergantung kepada jenis insuran perubatan yang diambil. Semakin luas perlindungan perubatan yang diberikan, semakin mahal jumlah premium untuk polisi insurans perubatan tersebut.

Apakah perlindungan yang diliputi oleh insurans perubatan?

Jenis perlindungan yang diberikan oleh insurans perubatan boleh menjadi menyeluruh, meliputi kos pembedahan dan rawatan penyakit, atau hanya meliputi perkara asas sahaja seperti kos wad dan penyakit yang tidak serius. Oleh itu, pastikan anda faham perlindungan yang ditawarkan supaya ia sesuai dengan keperluan anda sebelum anda membeli insurans perubatan. Secara asasnya, terdapat empat jenis utama insurans perubatan di Malaysia:

Insurans kemasukan ke hospital dan pembedahan: menyediakan perlindungan untuk kos rawatan di hospital dan kos pembedahan untuk penyakit yang tersenarai dalam polisi.

Insurans penyakit ditakuti dan penyakit kritikal: menyediakan faedah sebaik sahaja didiagnosis 36 jenis penyakit kritikal.

Insurans pendapatan hilang upaya: menyediakan sumber pendapatan berterusan untuk menggantikan pendapatan sebelum hilang upaya dan jika tidak mampu berkerja akibat dari penyakit atau kecederaan.

Insurans pendapatan hospital: menyediakan bayaran, sama ada harian, mingguan, atau bulanan, bergantung kepada had perlindungan, sekiranya anda perlu dirawat di wad hospital untuk proses pemulihan.

Ketahui bahawa kebanyakan insurans perubatan memiliki syarat pra-wujud. Dengan syarat ini, jika anda menghidap penyakit sebelum mengambil insurans (contohnya tekanan darah tinggi), anda tidak layak untuk memohon perlindungan untuk membayar kos rawatan untuk penyakit sedia ada tersebut.

Mengapa Insurans Perubatan penting?

Insurans perubatan akan membantu anda untuk melangsaikan kos yang terlibat sewaktu anda dimasukkan ke hospital dan juga kos rawatan jika anda diserang penyakit. Kos ini termasuk wad, pemeriksaan, pembedahan, ubat, rawatan susulan, dan lain-lain. Insurans perubatan juga menawarkan bantuan sekiranya anda tidak mampu bekerja disebabkan oleh penyakit atau kecederaan.

Tidak kira apa jua insurans yang anda mohon, pastikan anda fahami perlindungan yang ditawarkan oleh polisi insurans tersebut. Dapatkan penjelasan sekiranya terdapat maklumat yang kabur dalam polisi tersebut.

Lihat juga: 12 Cara untuk Jimatkan Kos Perubatan di Malaysia

Save

Save

Save

Read More

Credit Card 101: Everything You Need To Know About Credit Card

- By CompareHero.my

- March 4, 2021

Contents

- What is a credit card?

- What is the difference between a credit card and a debit card?

- Why do I need a credit card?

- How do credit cards work?

- The pros and cons of using a credit card

- What is a supplementary card and when should I apply for one?

- Charges and fees

- What is a credit limit and how is it calculated?

- What are interest rates and how is it calculated?

- What is minimum payment and how is it calculated?

- What is an annual fee?

- What is a late payment fee?

- Foreign Transaction Fee versus Dynamic Currency Conversion

- How do I apply for a credit card?

- How long will it take to apply for a credit card?

- How many credit cards can I have?

- Credit Card Providers

- What is the difference between Visa, Mastercard, and American Express?

- How do banks make money from credit cards?

What is a credit card?

A credit card is a way to pay for goods and services and is essentially a type of short term loan issued by a bank or a financial institution to the account holder. This means that whenever you spend with your card, you’re borrowing money from the bank and paying for it with credit. Before your credit card is approved, the bank will review your credit history and monthly income to decide the maximum amount you can spend on your card (credit limit) and other terms. This differs from application to application.

A credit card is a substitute for cash and is often used for short-term financing. This includes using it for daily spending on goods and services, or for expensive purchases when withdrawing a large amount of cash does not make sense. You must pay for your purchases made on credit within 30-days of purchase to avoid being charged interest.

A credit card is not a good solution for long-term financing because of its high interest rates. In fact, it can be one of the more expensive options as some credit cards charge an interest rate of 18%, which is the highest in the market. Instead, a personal loan would be a better option for long-term and you can find financing with interest from as low as 5%.

Interest rates different between the various banks and type of credit card. It may also fluctuate based on how prompt your repayments are. If you pay your dues in a timely manner, you’ll be rewarded with a lower interest rate. Your credit score can also impact the interest rate offered to you, typically, the healthier your credit score, the lower the interest rate.

What is the difference between a credit card and a debit card?

In simple terms, a credit card allows you to spend with borrowed money and pay it back later. It is not linked to your bank account and allows you to spend money up to your credit limit. You then have a choice to repay the amount spent within 30-days in full and avoid being charged interest or to repay a minimum amount which will be charged interest.

A debit card is directly linked to your bank account (current or savings) and only lets you spend money you already have in your account. Each purchase is automatically deducted from your bank account. You, therefore, need to ensure you have sufficient money in your bank account before you make a purchase with your debit card.

Related: Shopping Tips: When To Use A Debit Card Or Credit Card?

Why do I need a credit card?

A credit card can offer you many benefits through its features and can be a great tool to manage your finances. However, it’s critical to equip yourself with the knowledge on how to use one to avoid landing yourself in an expensive mound of debt.

A credit card is a great substitute for cash provided that you are able to repay the amount you spend each month. A few reasons it’s worth considering include:

- It’s safe to carry around than a wad of cash

- You get to enjoy extra benefits including protection on your purchases, cashback, air miles and rewards, and discounts or promotions with retail outlets or restaurants

- It can be good for your credit score to build credit history, which is needed when applying for other personal finance products such as loans and mortgages

- It can also help you pay for expensive purchases with a 0% interest easy payment plan that splits your lump sum payment into affordable instalments over a duration of months or over a few years. This gives you time to repay the bank for your purchase without being charged interest, however, if you fail to repay the amount within this duration, you will be charged the full interest rate on your balance.

Our credit card guides can help to equip you with the information you need to avoid landing yourselves in a huge amount of debt.

How do credit cards work?

There are a few components to understanding how a credit card works. We’ll break it down for you.

For purchases: A credit card allows you to pay for goods and services in person or online. For online payments, you simply need to key in your credit card details, complete with security checks, and the transaction will be processed provided that you have not exceeded your credit limit. For in-store purchases, a simple swipe or tap your credit card at the payment terminal and authorise the transaction with either a PIN or a signature. This entire process goes through multiple parties however it will feel like a seamless experience for you.

Typically, there are five parties involved in a credit card transaction:

- Cardholder: You or any other authorised person (like your spouse or children whom you’ve given supplementary cards to) who can use the credit card to make purchases

- Card Issuer: Institutions, such as banks and consumer finance companies, that issue credit cards

- Credit Card Network: Organisations that set up the payment ecosystem and act as the middlemen between merchant acquirers and card issuers (like Visa, MasterCard and American Express)

- Merchant Acquirer: Institutions, often banks, which process credit card transactions for merchants using a POS terminal

- Merchant: Retailers, restaurants and e-commerce sites around the world that allow credit cards as a form of payment

Source: wallethub.com

Credit card repayments: You will need to repay the bank the full amount you have spent on credit. To avoid being charged interest on your outstanding amount, you will need to clear off your balance within 30-days of making the purchase. However, if you do not wish to pay the full amount on your credit card statement every month, you will need to repay at least the minimum amount. It is always best to repay more than the minimum amount because it may then take you years to clear off your outstanding balance and you will have incurred extra costs in the form of interest rate charges.

The pros and cons of using a credit card

Before applying for a credit card, it’s important to understand its advantages and disadvantages. A credit card can be extremely beneficial for you when used responsibly, you can enjoy the ease of the “buy-now-pay-later” concept and earn cashback, rewards or air miles every time you spend. However, it’s important to realise there are pitfalls to a credit card if mismanaged, which will cause you to pay a very expensive credit card bill with high-interest rate charges and racking up more debt than you can afford.

Pros

- Speed and Efficiency: A credit card is extremely easy to carry around, it’s weightless and doesn’t take up much space in your wallet. In fact, it’s hard to tell you even own one. Unlike a wad of cash that would be quite obvious hence making it a little less secure to carry around with you. Paying with a credit card is quick and seamless, often requiring nothing more than a swipe or tap on the payment terminal. You then key in your PIN or authorise the purchase with your signature and the transaction is complete.

- Protection: Unlike cash, credit card providers usually offer their customers protection on the purchases made with their card. A purchase protection plan offers coverage against theft or accidental damage. Coverage varies between providers so be sure to check if it is included in your credit card if this is a feature you are looking for.

- Buy-now-pay-later: For times when you need to make an expensive purchase and can’t afford to pay for all of it in one go, credit cards are a great solution. With the Easy Payment Plan (EPP) option, you can break your lump sum payment into affordable monthly instalments at 0% interest over a specific duration. This essentially allows you to borrow money for free through your card, as you aren’t being charged any additional interest. However, if you miss the deadline you’ll be paying the price for it with interest being added to your outstanding balance at the end of every month.

- Earn benefits while you spend: When paying with cash, once the money leaves your hand you walk away with your purchased item and that’s about it. With a credit card, you can opt to apply for a card that provides you added benefits every time you spend which includes cashback, reward points, and air miles to name a few. This is only worthwhile if you are able to pay your bill in full – else the interest that you get charged on the outstanding balance each month cancels out the value of the rewards.

- Emergency aid: In times when you are in need of extra funds and can’t seem to find an ATM near you to withdraw cash, a credit card can come to your rescue. It’s a security blanket that offers that assurance you will still have some form of payment if anything goes wrong with your debit card or you’re suddenly out of cash.

- Good for your credit score: This is true only if you are able to use your credit card responsibly and can demonstrate your ability to make for your bills on time while paying off more than the minimum amount.

| PROS | CONS |

|

|

Cons

- The debt trap: It’s easy to forget as you’re spending with your credit card, that you’re actually using borrowed money which you always have to pay back. As easy as using a credit card is, there are risks involved of which the major one is falling into a spiral of debt. Because you’re not parting with physical cash each time you make a payment, it’s easy to lose track of your expenses. Once you find that you’re unable to pay off the total bill at the end of each month, you’ll start to rack in added charges in the form of high-interest Your debt will start to spiral out of control month-on-month and you’ll find yourself in a nasty cycle. You should always try to pay off more than the minimum amount and think of your credit card as a short-term financial tool.

- Hidden charges and fees: The interest rate is not the only charge or fee you’ll have to worry about. There are others that you don’t necessarily notice until your monthly statement arrives which includes the annual fee, late payment fee, and penalty fees when you exceed your credit limit. These can creep up on you without realising it so be sure to always read the terms and conditions of your credit card.

- Expensive cash advance: Unlike your debit card, a credit card should not be used to withdraw cash from the ATM. This is usually the last resort and only in cases of ultimate emergencies. Why? Because the interest rate you’re charged on cash advance withdrawals is usually the highest the bank will offer (between 17% – 18%) and isn’t worth it. On top of that, you get charged a 5% transaction fee every time you withdraw.

- Can be bad for your credit score: This is true especially if you get caught in the debt trap and find yourself unable to make timely payments or if you can only afford to pay the minimum amount every month.

- Fraud and scams: The main danger with carrying cash is usually theft. However, with credit cards, you are susceptible to other crimes including scams or fraudulent activity. Most credit cards are equipped with safety and security features to protect your account and your purchases, however, there are instances when you might find a fraudulent charge on your statement. Or you may have fallen victim to a very convincing scam which sees you divulging confidential information at risk of losing the security of your credit card. In instances such as these, contact your credit card provider immediately and there are measures in place to ensure this is rectified.

What is a supplementary card and when should I apply for one?

A supplementary card is an additional credit card that is issued under the principal account holder’s name upon request. As the principal account holder, you can decide who to give the supplementary card to. However, a supplementary card holder must be at least 18 years old and most times this is given to your spouse or to your child.

A supplementary cardholder does not need to fulfil the minimum requirements as per principal account holder, which makes it a perfect option or your spouse who may not be working or your child who needs a card for emergency cases. It is a great option if you and your spouse want to consolidate your spending into a single credit card account. You will be able to earn rewards at a faster rate because the cards are linked to a single account holder. However, this also means the danger of spiralling into debt is a lot easier as every single spend is reflected in a shared bill.

Charges and fees

What is a credit limit and how is it calculated?

When you apply for a credit card, the bank reviews two main factors to determine your credit limit – your credit history and monthly income. Your credit limit is the maximum amount of money you can spend on your credit card. In Malaysia, for cardholders earning RM36,000 or less per year, their credit limit cannot exceed two times their monthly income. For cardholders earning more than RM36,000 per year, your credit limit is decided by the banks at their discretion based on your credit history and monthly income. This is in accordance with regulations by Bank Negara Malaysia (BNM).

What are interest rates and how is it calculated?

Interest is a charge applied by banks for lending you money. It is calculated as a percentage of your outstanding balance. The rate is determined by the bank upon review of your credit history and other factors in your application. Generally speaking, the better your credit score, the lower your interest rate. A healthy credit score demonstrates that you are in a healthy financial position and it is less risky for the bank to approve your application, therefore charging you a lower interest rate.

Some banks also offer an interest-free or grace period for purchases made when you first receive your credit card. This can range from the first 20 days and basically means you receive no interest if you pay your bill in full. We recommend taking advantage of this grace period while you can, but be sure that you can afford to repay the amount on your card before the interest-free period is over.

As of 2011, BNM introduced the tiered interest rates to help consumers manage their debt. A tiered interest rate involves different rates of interest depending on whether the cardholder can make timely repayments. For instance, the bank may offer you interest rates between 15% to 18% and this depends on how prompt your repayments are. For prompt repayments over a 12-month duration, they may decide to charge you the lower rate of 15%, however, if you consistently make late repayments they may decide to charge you the higher rate of 18%.

Interest rates for credit cards vary widely, from around 8% to around 15%. Interest can be charged on retail purchases, balance transfers and cash withdrawals. Usually, different rates are charged for each category, with balance transfers having a lower rate and cash withdrawals having a higher rate.

Note: interest rates for credit cards are mostly charged on a variable interest rate, which means that your interest rate might change with little to no notice. Go through your monthly statement to keep track of the interest rate charged on your credit cards.

What is minimum payment and how is it calculated?

When your credit card statement arrives, you’ll notice that there will be your total outstanding balance amount and a minimum amount. This is the very least you need to repay for that month, and you can opt to pay just the minimum amount, the whole bill, or any amount you choose.

If you only pay the minimum amount, you’ll start paying interest on your outstanding balance so we do not recommend doing this. It will take a lot longer to pay off your debt, and you’ll end up paying a lot more than you borrowed. Always pay more than minimum.

Most, if not all banks use this formula to calculate the minimum monthly payment: 5% of the outstanding balance or a minimum of RM50, whichever is higher.

Related: How Credit Card Minimum Payments And Interest Are Calculated

What is an annual fee?

An annual fee is a maintenance fee that is charged by the credit card provider. The actual fee will depend on the bank and may differ depending on the tier of the credit card. Basic cards may come with zero annual fees whilst the more exclusive or premium cards may come with an RM1,215 annual fee (most expensive in the market) due to its exclusive features and benefits that are costly to maintain. Some banks waive off annual fees depending on cards usage and promotions or on the minimum spend/number of swipes per year. But be warned that at times, the minimum spend level required to waive the annual fee is unattainable. For example, Maybank’s World Mastercard requires a minimum annual spend of RM120,000 (RM10,000 monthly) in order to waive its RM1,000 annual fee.

What is a late payment fee?

If you make your payment after the monthly deadline on your statement, you might have to pay a late payment charge. Not only do you incur higher charges for the month, this may reflect poorly on your credit history and may translate a lower credit score. Most banks in Malaysia charge you 1% of your outstanding balance r RM10 (to a maximum of RM100), whichever is higher.

Foreign Transaction Fee versus Dynamic Currency Conversion

Many cardholders may not realise this but there are actually two types of fees that can be charged to your credit card when you travel overseas. The Foreign Transaction Fee or the Dynamic Currency Conversion (DCC).

A foreign transaction fee is a fee charged by the bank or credit card issuers on every transaction that is made outside of the card issuer’s country of origin. The fee differs for every card depending on the bank or card issuer, however, can be as low as 1%.

Similar to a foreign transaction fee, the DCC is a fee charged by the merchants to convert your purchase into ringgit or your home country’s currency. On the upside, it is convenient for because you instantly know how much the transaction will cost you in RM, but there is a catch. More often than not, this conversion is carried out by merchants with less competitive currency rates, so they may charge you a marked-up fee. On top of that, the merchants would make and earn an extra profit by charging the higher rate through DCC on the transaction. It could be more expensive for you than the 1% foreign transaction fee. Hence, we recommend opting for the Foreign Transaction Fee when making payments overseas.

The key to remember is that you have the option to choose to charge your card with the foreign transaction fee or to opt for the dynamic currency conversion.

How do I apply for a credit card?

Do your research: For starters, you need to figure out the right credit card for you based on your budget and lifestyle needs. The best way to do this is research. By visiting financial comparison sites like CompareHero.my, we do the hard work for you. With our free comparison tool, all you need to do is key in important details to help us narrow down the best cards for you based on your income level, spending needs, and more. Within 30 seconds, we’ll be able to offer you a range of credit cards that work for you. Be sure to review the benefits and features that come with the card, assess the additional fees and charges you would need to pay including annual fees, and determine if it offers you the added benefits you need like cashback or air miles or reward points. Also, be sure to determine that you can meet the minimum requirements for a successful credit card application. Research is key and each bank or card issuer will offer you a different card, find the one that works for you best.

Check your credit score: You will also need to check your credit score and you can do this with the various agencies including CTOS, CCRIS, and RAMCI to name a few. Knowing your credit score will help you determine if your application is likely to be approved or declined. A healthy credit score shouldn’t face any issues; however, an unhealthy credit score may need to be fixed and these improvements could take up to 6 months to reflect in your credit score.

Related: How Credit Cards Can Affect Your Credit Score

Understand you may not get the rates as advertised online: The interest rates online are advertised and may not necessarily be the interest rate that you will be offered by the bank. Why? Because the bank reviews each application individually and interest rates are usually determined based on your credit score and your monthly income.

Apply online or at a bank branch: Once you’ve found the right credit card for you, you can proceed to apply online via our website and be sure to submit all the required documents. Or if we currently don’t have a deal with the bank of your choice, you can proceed to the bank’s website. Online applications usually take up less time but if you prefer to speak to a customer service representative, you can walk into a bank branch and apply with them face-to-face. Just be sure to have all the required documents handy.

How long will it take to apply for a credit card?

If you’re applying for a credit card online, the actual process doesn’t take much of your time, perhaps 10 – 15 minutes max. If you’re walking into a bank branch, this would depend on the speed of the service provided.

Once you apply through our website, one of our Customer Heroes will be in touch with you within 1-2 days to verify your details and application. Upon verification, the application will be sent to the bank, and you can expect to hear from the bank once your application is approved within 1-2 weeks.

How many credit cards can I have?

In 2011, BNM announced new measures for credit card holders. If you are earning RM36,000 per annum or less, you are only allowed to hold a maximum of two (2) credit cards, from a maximum of two (2) credit card issuers. This means you can get two credit cards from a single bank or up to two banks, but nothing more.

If you earn more than RM36,000 per month, there is no restriction to the number of credit cards you can hold. However, we encourage you to assess your affordability and debt levels before applying for too many credit cards under your name.

Credit Card Providers

- AEON Credit Service

- Affin Bank

- Alliance Bank

- AmBank

- Bank Islam

- Bank Rakyat

- BSN

- CIMB Bank

- Citibank

- Hong Leong Bank

- HSBC

- Maybank

- OCBC

- Public Bank

- RHB Bank

- Standard Chartered

- UOB

What is the difference between Visa, Mastercard, and American Express?

Visa, Mastercard and American Express do not issue credit cards, it is issued by banks or financial institutions. Visa, Mastercard and American Express are known as payment networks, they’re basically the computer systems that allow for processing of credit card transactions. They make money off each transaction. As a cardholder, you won’t find big differences between Visa and Mastercard.

However, American Express (Amex) is slightly different. For one, it is not as widely accepted by merchants because of the cost issues. Amex has a slightly higher processing fee compared to Visa and Mastercards. Two, they issue their own cards which mean they determine their own interest rates, fees, and payment schedules (not the banks).

As an overview, some of the benefits with these payment networks include:

- Global Customer Assistance Services 24/7 no matter where you are in the world so you can report problems or lost/stolen credit cards.

- 24/7 Concierge services including helping you to make last-minute dining reservations, flight reservations to name a few.

- Deals and discounts exclusive to your card type

- Globally accepted by millions of merchants around the world so you won’t ever have to worry about not being able to pay with your credit card

- Global ATM network allowing you to withdraw cash when you need it

- Exclusive access to airport lounges, golf clubs, and premier hotel memberships

How do banks make money from credit cards?

Fees and charges: Annual fees, late payment fees, cash advance charges and foreign currency transaction fees are some of the popular items on the menu, courtesy of your credit card provider (a.k.a the bank). Even if you’re someone who always pays their bills on time and has never been charged with interest, banks still rake in a lot of profit from you via an assortment of fees and charges.

Interest rates: Credit card interest is easily bank’s biggest form of revenue, as most of the banks in Malaysia charge an average of 11% to 18% of interest on outstanding balances. Banks especially rake in their income off cardholders who the minimum or late payments, because the more balance you carry forward over a longer period of time, the higher the interest rate will get.

Merchant fees: A lot of people are unaware of this, but the higher your spending power is (in retail purchase), the more profit the banks make. Each time you make a purchase from a merchant, a small percentage of what you pay (usually ranging from 1% – 3%) will go the credit card’s issuing bank as an interchange fee.

This typically doesn’t directly affect you as a consumer, but some small-scale businesses will ask to charge you that 1%- 3% instead, although they are obliged by law to inform you of it beforehand.