Banking

Your guides to diving into the world of banking and finance!

All articles

Ready, Set, Grow: Start Your Business Right With A Maybank Business Account

Last updated

May 30, 2023

Grow Your Wealth With The Right Banking Account

Last updated

Apr 27, 2023

Celebrate World Cup 2022 with Bank Islam’s Limited Edition Visa FIFA-Themed Credit Card-i

Last updated

Jun 15, 2022

5 Ways To Improve Your Credit Score

Last updated

Mar 22, 2022

4 Ways A Bad Credit Score Can Impact Your Life (And How You Can Fix That)

Last updated

Mar 15, 2022

9 Sistem Pembayaran Online (Digital Cashless) Di Malaysia

Last updated

Feb 11, 2022

Guide to Calculating Flat Rate Interest and Reducing Balance Rate

Last updated

Dec 7, 2021

CIMB Is Introducing A New Term Investment Account That's Perfect For SMEs In Malaysia!

Last updated

Nov 10, 2021

You Can Have 4 Types of Bank Accounts in Malaysia, But What's Right For You?

Last updated

Oct 4, 2021

Transferred Money To The Wrong Bank Account? Here's What You Should Do

Last updated

Sep 6, 2021

Are You Eligible For The Special Covid-19 Assistance (BKC)? Here's How You Can Find Out

Last updated

Sep 2, 2021

6 Things To Know About The Moratorium Before You Sign Up For It

Last updated

Jul 10, 2021

Should You Open A Joint Bank Account With Your Spouse?

Last updated

Jun 30, 2021

3 Easy Ways For Maybank Customers To Apply For COVID-19 Post-Moratorium Assistance

Last updated

Jun 25, 2021

4 Reasons Why Your Business Should Have a Business Bank Account

Last updated

Jun 8, 2021

Personal Banking vs Business Banking: Do I Need Separate Accounts?

Last updated

Jun 8, 2021

Perbezaan Diantara Kadar Keuntungan dan Kadar Faedah

Last updated

Jun 1, 2021

How Bank Interest Rates Work On A Savings Account? Here’s A Mini Guide

Last updated

Apr 23, 2021

Apa Itu Kemudahan Overdraf Bank?

Last updated

Feb 26, 2021

Cara Pengiraan Kadar Faedah Rata Dan Baki Berkurangan Pinjaman Bank

Last updated

Feb 15, 2021

I’m Only 21 Years Old. Do I Need A Credit Score?

Last updated

Feb 5, 2021

Ask The Expert: Avoid These 6 Mistakes If You Want A Great Credit Score

Last updated

Jan 29, 2021

BNM Maintains OPR At 1.75% - What Does This Mean For Malaysians?

Last updated

Jan 27, 2021

Don’t Fall For These 5 Credit Score Myths!

Last updated

Jan 18, 2021

#CHInsights - How Does Credit Accessibility Impact Financial Inclusivity?

Last updated

Jan 14, 2021

Bank Negara Malaysia Reassures Borrowers Repayment Assistance To Continue Until Next Year

Last updated

Nov 27, 2020

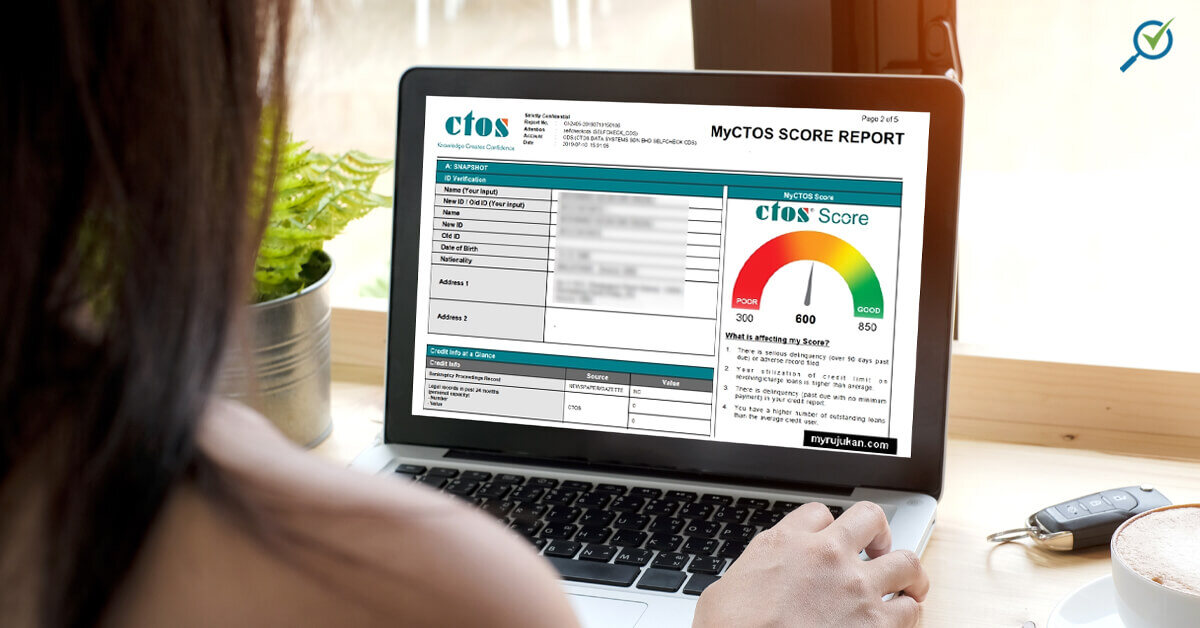

How To Read Your Credit Report Using This Code

Last updated

Nov 25, 2020

BNM Announces Additional Measures To Assist Individuals And SMEs Affected By COVID-19

Last updated

Nov 11, 2020

Is Your Credit Score Good Enough To Get You A Mortgage? Here’s Why It Matters

Last updated

Nov 5, 2020

How Malaysians Can Take Advantage Of The Lower Overnight Policy Rate (OPR)

Last updated

Nov 4, 2020

Banking Institutions To Assist Borrowers And Customers In CMCO And EMCO Areas

Last updated

Oct 13, 2020

All You Need To Know About Maybank’s New MAE Mobile Banking App And MAE Visa Debit Card

Last updated

Oct 12, 2020

Maybank - First Bank To Introduce Online Appointment Management System, EzyQ

Last updated

Oct 9, 2020

Digital Banks Are On the Rise In Malaysia - What Does This Mean for You? Experts Weigh In

Last updated

Aug 27, 2020

What Is A CTOS & CCRIS Report And What's Their Difference?

Last updated

Aug 18, 2020

How To Increase Your Credit Limit Without Affecting Your Credit Score In Malaysia

Last updated

Jun 11, 2020

2020 OPR Cuts: What Does This Mean For Malaysians? [UPDATED]

Last updated

Feb 9, 2020

9 Digital Mobile Payments in Malaysia That You Need To Know About

Last updated

Jan 16, 2020

Maybank: Service Charge for Card & Loan Repayments begin 1 October 2019

Last updated

Jan 16, 2020

How Much Do You Know About Islamic Finance?

Last updated

Jan 15, 2020

Highlight of Consumer Credit Law at National Strategy for Financial Literacy Launch

Last updated

Nov 25, 2019

Citibank Application is Now 100% Online - What Does This Mean?

Last updated

Nov 25, 2019

CompareHero's parent, CompareAsiaGroup raises US$20M in Series B1 funding led by Experian

Last updated

Nov 25, 2019

Here Are The Best Cash Financing Options

Last updated

Nov 19, 2019

Which Is The Best Digital Wallet: Visa Checkout, PayPal or MasterPass?

Last updated

Oct 31, 2019

RHB Launches Multi-Currency Debit Card Supporting 13 Foreign Currencies

Last updated

Oct 22, 2019

CIMB, OCBC, & RHB Reduces Their Base Rates & Base Lending Rates

Last updated

Aug 27, 2019

National Strategy for Financial Literacy 2019-2023

Last updated

Aug 26, 2019

Akaun Simpanan Junior Terbaik

Last updated

Aug 23, 2019

UnionPay - The Leading Global Payment Network

Last updated

Aug 23, 2019

Overdraft Facilities: A Type Of Demand Loan Offered By Banks

Last updated

Aug 19, 2019

How To Sign Up & Use Alipay Mobile Wallet In Malaysia

Last updated

Aug 5, 2019

What Is Your Net Worth?

Last updated

May 3, 2019

Find Out What These Credit Reporting Agencies Say About Your Credit History

Last updated

Apr 8, 2019

Bitcoin Debit Cards: An Introduction to Malaysians

Last updated

Apr 1, 2019

Interest Rates: Nominal meets Real meets Effective

Last updated

Apr 1, 2019

The AmBank Group/RHB Banking Group Merger: How will it affect you?

Last updated

Apr 1, 2019

The Economic Outlook and Drivers of Growth in Malaysia

Last updated

Mar 27, 2019

The Basic of Islamic Banking

Last updated

Mar 11, 2019

Samsung Pay in Malaysia: Here’s What You Need to Know

Last updated

Mar 11, 2019

Transferring Money to the UK? Here’s a Cheaper Way

Last updated

Mar 4, 2019

Differences Between Syariah and Conventional Financing

Last updated

Mar 4, 2019

Get Red-Carpet Treatment with Premier Banking Privileges

Last updated

Mar 4, 2019

Our Mission

We'll help you make your next financial move the right one.

.png)