Cards

Mastering The Art Of Credit And Debit Cards: Your Comprehensive Guides

Featured Articles

Featured Articles

Jan 9, 2023

Popular articles

All articles

5 Best Travel Credit Cards in Malaysia

Last updated

May 7, 2024

Women's Month Sales in Malaysia 2024

Last updated

Mar 5, 2024

5 Best Joint Credit Cards for Couples

Last updated

Mar 4, 2024

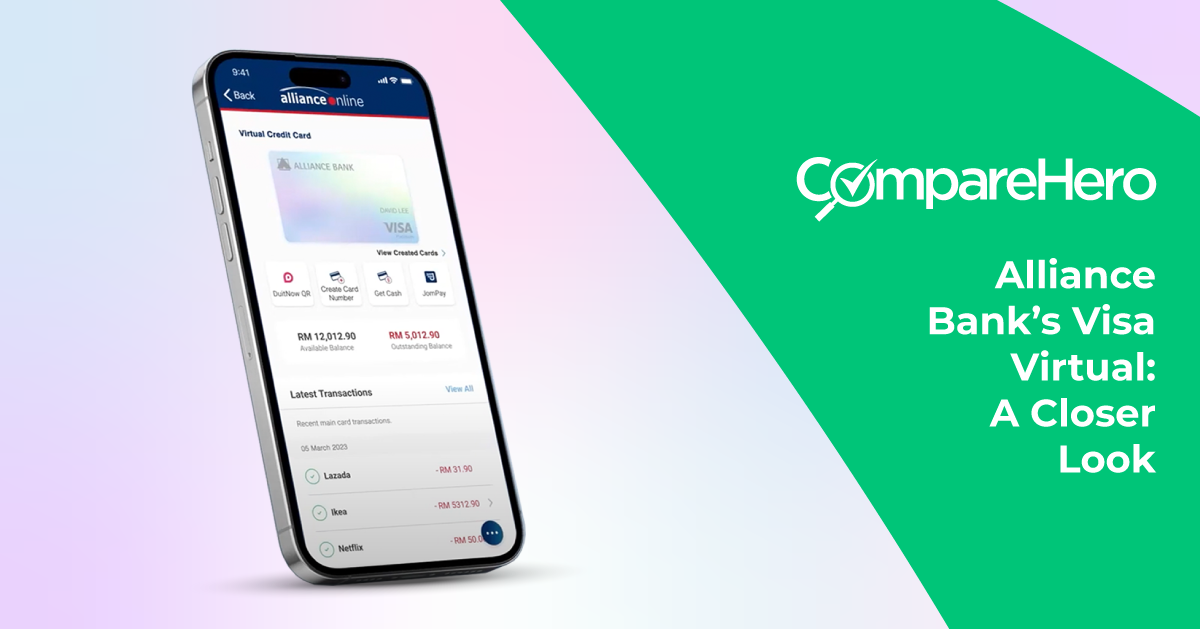

Alliance Bank's Visa Virtual: Malaysia's First Virtual Credit Card

Last updated

Feb 6, 2024

How Travel Credit Cards Work- 5 Benefits You Should Know

Last updated

Feb 2, 2024

Money Horoscope 2024: Best Credit Cards According to Your Chinese Zodiac

Last updated

Jan 31, 2024

Best Credit Cards in Malaysia 2024

Last updated

Jan 9, 2024

When and How to Move Beyond Your First Credit Card

Last updated

Sep 14, 2023

What Standard Chartered Credit Cards Should You Get?

Last updated

Aug 28, 2023

How to Choose the Best Credit Card for Online Shopping in Malaysia

Last updated

Jul 25, 2023

Enjoy A World Of Rewards With Standard Chartered Journey Credit Card

Last updated

Jun 13, 2023

Take your travels to the next level with HSBC TravelOne Credit Card

Last updated

May 16, 2023

What is Credit Card Purchase Protection?

Last updated

Feb 7, 2023

Pros & Cons Of Terminating Your Credit Card

Last updated

Nov 15, 2022

New CIMB Travel Credit Cards Reveal Designs & Amazing Annual Fee Waivers

Last updated

Oct 26, 2022

Best Zero Annual Fee Credit Cards & Other Benefits

Last updated

Oct 17, 2022

6 Common Mistakes First-Time Credit Card Users Make

Last updated

Oct 11, 2022

How Many Credit Cards Should You Have?

Last updated

Oct 4, 2022

CIMB Launches 3 New Credit Cards To Feed Your Wanderlust!

Last updated

Sep 30, 2022

Best Credit Cards With FREE Gifts To Apply This Week

Last updated

Sep 7, 2022

Malaysians Love Free Gifts! Here’s How You Can Claim Yours

Last updated

Aug 17, 2022

You Only Need This To Claim The Newly-Launched Marshall Emberton II For FREE!

Last updated

Aug 9, 2022

Type Of Credits Cards To Match Your Malaysian Personality

Last updated

Aug 4, 2022

Best Dining Credit Cards For August 2022

Last updated

Aug 2, 2022

Simple Tips To Avoid Overspending On Your Credit Card

Last updated

Jul 18, 2022

5 Awesome Credit Cards For e-Wallet Users

Last updated

Jun 16, 2022

Credit Card Past Promotions Terms and Conditions

Last updated

Jun 2, 2022

Here are credit cards you can apply for based on your salary!

Last updated

May 25, 2022

5 ways Alliance Bank’s new virtual credit card is changing the game!

Last updated

Mar 17, 2022

5 Good Reasons You Should Apply For A Credit Card

Last updated

Feb 28, 2022

Choosing Your First Credit Card In Malaysia: What You Need To Know

Last updated

Feb 28, 2022

10 Ways To Prevent Credit Card Identity Theft in Malaysia

Last updated

Feb 28, 2022

3 Requirements You Must Meet Before Applying For A Credit Card

Last updated

Feb 28, 2022

Should You Have More Than One Credit Card?

Last updated

Feb 28, 2022

5 Tips To Budget and Plan For Your Expenses Better in 2022

Last updated

Feb 21, 2022

6 Best Shopping Credit Cards For Malaysians In 2022

Last updated

Feb 18, 2022

Best Cashback Credit Cards in Malaysia 2022

Last updated

Feb 18, 2022

How to Apply for a Credit Card for Foreigners in Malaysia

Last updated

Feb 15, 2022

A Guide to Choosing and Applying for Credit Cards

Last updated

Dec 10, 2021

5 Important Things To Know Before Booking Your Next Flight

Last updated

Nov 24, 2021

4 Reasons Your Credit Card Is Better Than Cash When You're Travelling

Last updated

Nov 9, 2021

5 Things You Should Know About AmBank's New Metal Credit Card

Last updated

Nov 8, 2021

How To Reduce Your Monthly Expenses With A Smart Credit Card

Last updated

Sep 20, 2021

6 Confessions Of A Credit Card Junkie

Last updated

Sep 20, 2021

6 Reasons Why The Standard Chartered Smart Credit Card Is A Must For Every Millennial

Last updated

Sep 19, 2021

How Do Balance Transfers On Credit Cards Work?

Last updated

Sep 10, 2021

5 Things You Need To Know About The Maybank Shopee Credit Card

Last updated

Sep 8, 2021

VISA vs MasterCard: Is there any difference?

Last updated

Jul 19, 2021

Here's How The CIMB e Credit Card Could Convince You To Go Fully Digital

Last updated

Jul 6, 2021

4 Things to Know Before Getting Your First Credit Card

Last updated

Jul 5, 2021

5 Ways On How The Standard Chartered Smart Credit Card Helps You To Save More Digitally

Last updated

Jul 2, 2021

Best Credit Cards For Online Shopping In Malaysia

Last updated

Jun 25, 2021

Save Money With These Low Interest Rate Credit Cards

Last updated

Jun 25, 2021

5 Best Credit Cards For Travel Insurance

Last updated

Jun 24, 2021

Best Credit Cards For Free Airport Lounge Access

Last updated

Jun 24, 2021

6 Ways Using A Credit Card Helps You Save Money

Last updated

Jun 23, 2021

When Is A Debit Card More Dangerous Than A Credit Card?

Last updated

May 25, 2021

9 Types Of Credit Card Charges You Must Know About

Last updated

Apr 8, 2021

When’s The Best Time to Pay Your Credit Card Bill?

Last updated

Mar 8, 2021

Credit Card 101: Everything You Need To Know About Credit Card

Last updated

Mar 5, 2021

Easy Payment Plan (EPP): How Credit Card Instalment Works In Malaysia

Last updated

Mar 5, 2021

How Credit Card Minimum Payments And Interest Are Calculated

Last updated

Mar 2, 2021

6 Best Credit Cards For Malaysian Gen Zs

Last updated

Feb 22, 2021

How Credit Cards Can Affect Your Credit Score

Last updated

Jan 21, 2021

Be A Smart Shopper - Save And Earn More With The Lazada Citi Credit Card!

Last updated

Jan 20, 2021

Maybank Islamic Berhad Launches First-in-market Islamic Corporate Card With A Charity Element

Last updated

Dec 18, 2020

Personal Loan - Past Promotions Terms & Conditions

Last updated

Dec 18, 2020

What Is Contactless Payment?

Last updated

Dec 18, 2020

Top Credit Cards in Malaysia

Last updated

Nov 27, 2020

American Express Cards Are Rare In Malaysia - Here Are Ways You Can Use It

Last updated

Oct 23, 2020

5 Tips To Get The Most Out Of Your Credit Card

Last updated

Oct 7, 2020

4 Things We Love About The New AmBank Cash Rebate Visa Platinum Card

Last updated

Oct 5, 2020

What’s The Right Credit Card for You? A Guide According To Your Life Stages

Last updated

Sep 21, 2020

CIMB x Poptron #ExtraNotOrdinary Bazaar Empowers Over 100 Micro Brands Through COVID-19

Last updated

Sep 9, 2020

How Much Does It Cost To Get A Credit Card? Credit Card Fees Explained!

Last updated

Aug 13, 2020

How To Read & Understand Your Credit Card Statement? Your Credit Card Statement Explained

Last updated

Aug 6, 2020

How Cancelling Your Credit Card Can Affect Your Credit Score (Instead Of Helping It)

Last updated

Jul 15, 2020

CIMB Launches New e Credit Card: Here’s What You Need To Know - So Far

Last updated

Jul 6, 2020

Credit Card Application Rejected? 10 Tips To Get Approved For Your Next Credit Card Application

Last updated

Jun 18, 2020

The Best CIMB Credit Cards

Last updated

Jun 16, 2020

Don't travel without the Citibank PremierMiles Credit Card

Last updated

Mar 18, 2020

A Comparison Of Malaysia's Best Petrol Loyalty Cards

Last updated

Jan 20, 2020

How Islamic Credit Cards Work

Last updated

Jan 16, 2020

A First For Local Banks: UnionPay Credit Card by AmBank!

Last updated

Jan 16, 2020

Best Air Miles Credit Cards in Malaysia

Last updated

Jan 16, 2020

Best Credit Cards to Pay Utilities Bills in Malaysia

Last updated

Dec 30, 2019

Best Ways To Earn & Redeem Your Malaysia Airlines Enrich Points

Last updated

Dec 13, 2019

Revisions to Credit Card Minimum Monthly Payments: Citibank, HSBC, Hong Leong bank

Last updated

Nov 25, 2019

HSBC Platinum Credit Card - Now Up To 8X Points for Contactless

Last updated

Nov 25, 2019

Alliance Bank Credit Card Updates: Visa Infinite & Platinum Revision

Last updated

Nov 25, 2019

The Best Credit Cards for Different Income Groups – 2019 Edition

Last updated

Nov 22, 2019

Quiz: What's Your Credit Card Type?

Last updated

Nov 21, 2019

3 Budget Hacks For Your Next Lazada Adventure

Last updated

Nov 19, 2019

7 Ways Your Credit Cards Can Help You Save While Planning Your Vacation

Last updated

Nov 12, 2019

The Best Petrol Credit Cards For Malaysians

Last updated

Nov 8, 2019

Credit Card 102: Using your card

Last updated

Nov 1, 2019

The Best Balance Transfer Plans in Malaysia

Last updated

Oct 31, 2019

Ultimate Guide On Using Credit Cards Responsibly

Last updated

Oct 31, 2019

Cashback Credit Card Guide

Last updated

Oct 31, 2019

Complete Guide to Rewards Credit Cards

Last updated

Oct 31, 2019

Credit Card Fraud & Security

Last updated

Oct 31, 2019

Credit Cards: Cashback vs. Rewards

Last updated

Oct 31, 2019

Everything You Need to Know About Air Miles Credit Cards

Last updated

Oct 31, 2019

UnionPay Network Expands By Partnering Boost

Last updated

Oct 31, 2019

Your Guide To Islamic Credit Cards

Last updated

Oct 31, 2019

The Best Credit Cards for AirAsia BIG Points

Last updated

Oct 22, 2019

10x Points with Citibank & Lazada's New Shopping Credit Card

Last updated

Oct 15, 2019

Tired of Slow Card Deliveries? Get a Card Instantly instead!

Last updated

Oct 10, 2019

Top 5 Rewards Credit Cards In Malaysia

Last updated

Aug 29, 2019

Maybank Cashback & Rewards No More For eWallet

Last updated

Aug 27, 2019

Best Cinema Credit Cards in Malaysia

Last updated

Aug 26, 2019

What Happens If You Make Late Credit Card Payments

Last updated

Aug 26, 2019

Maybank Air Miles - Redeem up to 2,000,000 Air Miles per year

Last updated

Aug 26, 2019

How Should You Utilise Your AirAsia Big Points?

Last updated

Aug 22, 2019

Mid-Year Giveaway - 10 iPhone XS to be given away!

Last updated

Jul 23, 2019

Best Standard Chartered Credit Cards in Malaysia

Last updated

Jun 24, 2019

Citibank Credit Cards Reward You - Find out how!

Last updated

May 15, 2019

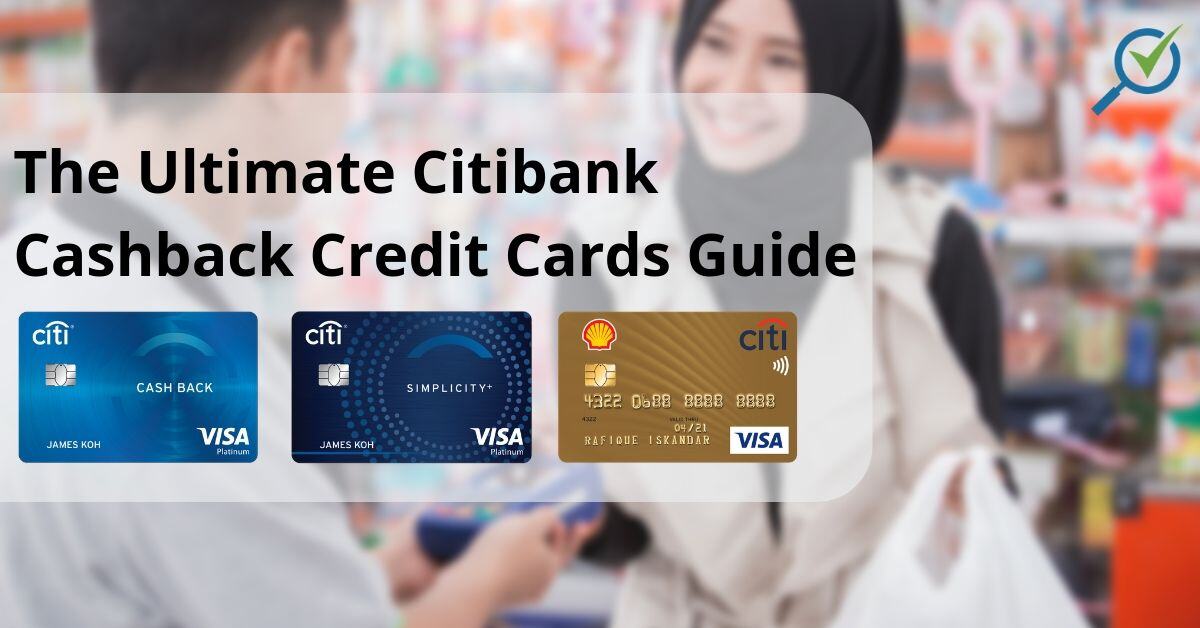

The Ultimate Citibank Cashback Credit Cards Guide - Which do you apply?

Last updated

May 15, 2019

Should Couples Share or Pay For Their Own Bills? [INFOGRAPHIC]

Last updated

May 3, 2019

Here are the 5 Best Credit Cards if You Just Started Working

Last updated

Apr 29, 2019

The Best CashBack Credit Cards For Groceries

Last updated

Apr 23, 2019

Apply, Spend and Win a Hisense 43" Smart TV (Worth RM1499)

Last updated

Apr 22, 2019

Do you choose a Standard Chartered Visa Platinum Credit Card?

Last updated

Apr 19, 2019

Pitfalls To Avoid When You Are Comparing Credit Cards [Webinar Playback]

Last updated

Apr 3, 2019

Battle of the Cashback Cards: Hong Leong WISE vs Standard Chartered JustOne Platinum Mastercard

Last updated

Apr 3, 2019

Sign Up For Malaysia's Best Basic Credit Cards With No Annual Fees! [INFOGRAPHIC]

Last updated

Apr 3, 2019

CompareHero.my Launches New Vertical – Serving Malaysians the Hero They Need

Last updated

Apr 2, 2019

Credit Card Requirements & Eligibility In Malaysia [INFOGRAPHIC]

Last updated

Apr 2, 2019

Shopping Tips: When To Use A Debit Card Or Credit Card?

Last updated

Mar 29, 2019

FREE Seats With AirAsia’s New Freedom Flyer Programme

Last updated

Mar 26, 2019

Discover the Best Frequent Flyer Program for You

Last updated

Mar 26, 2019

Redeem More Flights With AirAsia BIG’s Loyalty Program!

Last updated

Mar 26, 2019

Tips To Redeem Flights With ZERO AirAsia BIG Points

Last updated

Mar 26, 2019

How To Protect Yourself Against Credit Card Fraud 2016

Last updated

Mar 21, 2019

The Best Maybank Credit Cards in Malaysia for 2017

Last updated

Mar 21, 2019

5 Ways to Avoid The Dangers Of Credit Card Debt

Last updated

Mar 21, 2019

The Best HSBC Credit Cards in Malaysia

Last updated

Mar 21, 2019

Maybank Credit Card Buffet Deals

Last updated

Mar 13, 2019

CompareHero.my Promotion: 350K AirAsia BIG Points Giveaway

Last updated

Mar 13, 2019

Five Myths About Credit Cards Debunked [PODCAST]

Last updated

Mar 13, 2019

HSBC Credit Card Promotion

Last updated

Mar 13, 2019

CompareHero.my Pick & Go Promotion

Last updated

Mar 4, 2019

Exclusive American Express Credit Card Deals in Malaysia

Last updated

Mar 4, 2019

Game On - Alliance Bank Credit Card Promotion

Last updated

Mar 4, 2019

The Best AEON Credit Cards

Last updated

Mar 2, 2019

Credit Card Promo: FREE 20”+24” Condotti Luggage Bags

Last updated

Mar 1, 2019

ezbuy Malaysia Share & Win

Last updated

Jan 28, 2019

Our Mission

We'll help you make your next financial move the right one.

.png)

.png)